Why is saving and investing important?

Saving and investing are both important to consider in your future planning. Through saving money, your money is kept safe, and easy to access should you need it. By investing early over time, your money grows in value, benefiting from the magic of compounding.

Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals.

The Bottom Line

The sooner you begin saving for retirement, the better. When you start early, you can afford to put away less money per month since compound interest is on your side.

As savings held in cash will tend to lose value because inflation reduces their buying power over time, investing can help to protect the value of your money as the cost of living rises. Over the long term, investing can smooth out the effects of weekly market ups and downs.

Capital investment allows for research and development, a first step to taking new products and services to the market. Additional or improved capital goods increase labor productivity by making companies more efficient. Newer equipment or factories lead to more products being produced at a faster rate.

The savings are done by the households and private sectors in the banks, and these amounts of savings are further used in the investment process when banks loan them to the private or public sector. These both are important as they generate income, employment and leads to economic growth.

Capital for Investment: When you save money, you accumulate capital. This capital becomes the principal amount you can invest. It's like having bricks and mortar to build your financial house. The more you save, the stronger your financial foundation becomes.

Long-Term Security

The future is unpredictable, and financial emergencies can crop up anytime. Saving money allows you to create a safety net for your future expenses as well as unplanned financial needs. The more you save, the more peace of mind you have, as you are better prepared for anything life throws at you.

Ideally, you'd start saving in your 20s, when you first leave school and begin earning paychecks. That's because the sooner you begin saving, the more time your money has to grow. Each year's gains can generate their own gains the next year - a powerful wealth-building phenomenon known as compounding.

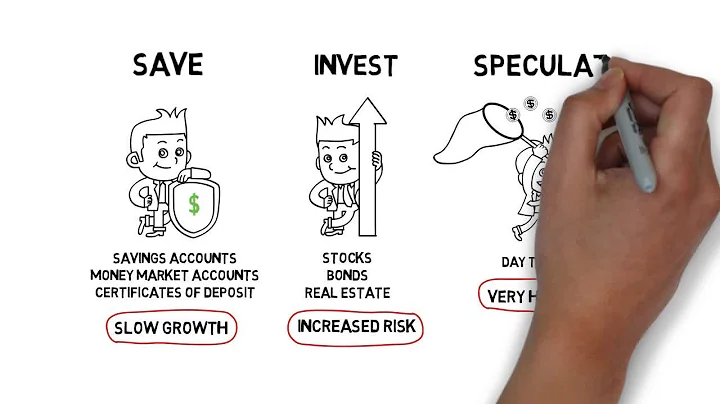

The difference between saving and investing

Saving can also mean putting your money into products such as a bank time account (CD). Investing — using some of your money with the aim of helping to make it grow by buying assets that might increase in value, such as stocks, property or shares in a mutual fund.

What are 3 reasons why you should invest?

- Grow your money when you start investing.

- Start investing to beat inflation.

- Achieve financial goals and spend on those you love.

- Achieve financial independence and retire comfortably.

- Investing is a necessary.

- Investing Makes Your Money Work for You.

- Invest to Beat inflation.

- Plant a Seed and Let It Grow.

- Plan Your Retirement.

- Tax Benefits Are Reasons to Invest Too!

Investing can help individuals become financially literate, understand the relationship between income, expenses, assets, and liabilities, and make informed financial decisions. Soft skills such as emotional control, self-discipline, and time management can be honed through investing.

Answer and Explanation:

Saving can be done continuously over time. ''Savings'' refers to amounts that households earn but do not spend, such as money held in a savings account.

Increased investment can lead to higher national income through job creation, increased productivity, and the multiplier effect. However, the exact impact depends on various factors, including the state of the economy, the source of financing, and the type of investment.

What Is Investment? By investment, economists mean the production of goods that will be used to produce other goods. This definition differs from the popular usage, wherein decisions to purchase stocks (see stock market) or bonds are thought of as investment.

Saving and investment theory is also referred to as income theory and was first used by economist Thomas Tooke. The main goal here is to explain variations in the price level or the value of money as per the classical investment theory view, assuming that the economy is always in full employment equilibrium.

An increase in saving increases the ratio of the capital stock to the given labor supply and initially raises the growth rate of output per capita.

The right investments can improve infrastructure, provide access to essential services, increase amenities and boost overall human development. These investments positively impact health, education and economic opportunities.

When planned savings is less than the planned investment , then the planned inventory rises above the desired level which denotes that the consumption is the economy was less then the expected level which indicates at less aggregate demand in comparison to aggregate supply.

How important is money in life?

It is just a tool that can help us achieve our goals. It cannot buy us love, good health, or happiness. However, it can provide us with the means to access the resources necessary for these things. In conclusion, the importance of money cannot be denied in today's world.

Why Do We Need Money? Money can't buy happiness, but it can buy security and safety for you and your loved ones. Human beings need money to pay for all the things that make your life possible, such as shelter, food, healthcare bills, and a good education.

The biggest difference between saving and investing is the level of risk taken. Saving typically results in you earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. This is called the 50/30/20 rule of thumb, and it provides a quick and easy way for you to budget your money.

Aim for building the fund to three months of expenses, then splitting your savings between a savings account and investments until you have six to eight months' worth tucked away. After that, your savings should go into retirement and other goals—investing in something that earns more than a bank account.