What is the relationship between saving and investing?

Saving and investing are both important components of a healthy financial plan. Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals.

The difference between saving and investing

Saving can also mean putting your money into products such as a bank time account (CD). Investing — using some of your money with the aim of helping to make it grow by buying assets that might increase in value, such as stocks, property or shares in a mutual fund.

Through saving money, your money is kept safe, and easy to access should you need it. By investing early over time, your money grows in value, benefiting from the magic of compounding. Remember that investing early, along with compound interest, can result in higher investment amounts versus a late investment start.

Answer and Explanation:

The savings/investment approach to equilibrium states that the relationship between savings and investment functions helps attain the equilibrium national income. In a saving economy, it is achieved by equating households' planned savings to planned savings by firms.

What is the difference between saving and investing? Saving you are putting money away to keep and use later. Investing you are putting money in, hoping that it will increase.

Saving your money is staying at the same amount and it is there when you need it. Investing is when you make money off of the money you put in and not all investments are easy to get money out of when you need it.

Depending on their maturity level and interests, some kids might enjoy following investments as early as grade school or middle school. The key difference between saving and investing is that money saved grows at a more predictable rate than money invested.

When planned savings is less than the planned investment , then the planned inventory rises above the desired level which denotes that the consumption is the economy was less then the expected level which indicates at less aggregate demand in comparison to aggregate supply.

Why is investing important? Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in value.

Investing has the potential to generate much higher returns than savings accounts, but that benefit comes with risk, especially over shorter time frames. If you are saving up for a short-term goal and will need to withdraw the funds in the near future, you're probably better off parking the money in a savings account.

What is the relationship between savings and investment in an open economy?

In a closed economy, domestic saving must equal investment ex post. In an open economy, the difference between domestic saving and net domestic investment is the current account balance.

Since growth depends critically on investment (broadly defined to include human capital), and resources for investment in developing countries are derived primarily from national saving, the latter is often seen as a key determinant of economic growth.

Saving and investing have many different features, but they do share one common goal: they're both strategies that help you accumulate money. “First and foremost, both involve putting money away for future reasons,” says Chris Hogan, financial expert and author of Retire Inspired.

Similarities between saving and investing

Both build wealth over time. A healthy financial strategy leans on both for a sound financial future. Both investing and saving require putting your money into a financial institution. For saving, that's a savings account at a bank.

Key takeaways

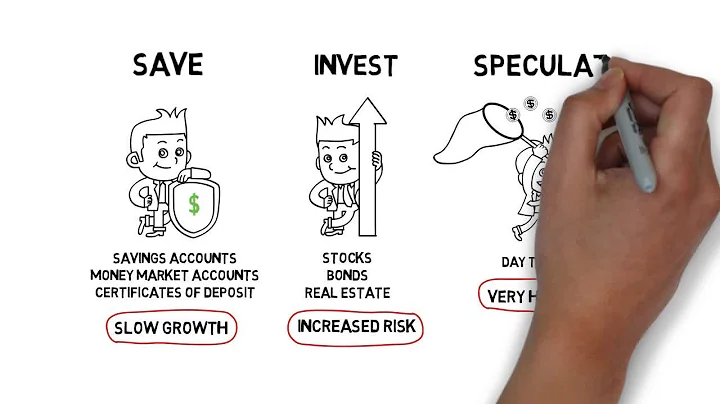

There's a difference between saving and investing: Saving means putting away money for later use in a secure place, such as a bank account. Investing means taking some risk and buying assets that will ideally increase in value and provide you with more money than you put in, over the long term.

The key difference is this: When you save money, you're putting your money somewhere safe to use for the future, often for short-term goals. Alternatively, when you invest money, you accept a greater potential risk in return for a greater potential reward. Investing often makes more sense for long-term goals.

What are Saving and Investment Plans? Saving and investment plans help you accumulate funds over a period of time. Depending on the type of financial goal you have – short-term or mid-term, or long-term, you can choose the period of investment. It is not necessary to stay invested in saving plans for at least 5 years.

Saving-Investment Approach (S-l Approach):

According to this approach, the equilibrium level of income is determined at a level, when planned saving (S) is equal to planned investment (I). If there is any deviation from the equilibrium level of income, i.e., if planned.

Investing is riskier than saving, but can also earn higher returns over the long term. Even accounting for recessions and depressions, the S&P 500 (composed of the U.S.'s 500 largest companies) has averaged just over 11 percent per year in returns since 1980.

Investing is the purchase of assets with the goal of increasing future income. Savings is the portion of current income not spent on consumption. The chance that the value of an investment will decrease.

When should you save instead of invest?

If your timeline for reaching the goal is five years or less, saving is a better strategy than investing. Note that high-interest debt balances can complicate your savings efforts. Some will argue it's better to pay off debt before you save. However, living without an emergency fund is risky.

Here are some of the potential consequences: Emergency Situations: Without savings, you'll be more vulnerable to unexpected expenses like medical bills, car repairs, or sudden job loss. This can lead to debt or financial stress.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

It's really only an issue if you're saving excessively at the expense of getting out of debt, maxing out retirement matches or underutilizing investments—or if you're still using traditional savings accounts rather than maximizing your earning potential with high-yield savings accounts.

- Make Money on Your Money. You might not have a hundred million dollars to invest, but that doesn't mean your money can't share in the same opportunities available to others. ...

- Achieve Self-Determination and Independence. ...

- Leave a Legacy to Your Heirs. ...

- Support Causes Important to You.