In this post you’re going to learn how to invest in share market in 2020.

In fact, it’s the same process which I still use to invest in best shares.

Why I call it as absolute guide?

Because this article can handhold it’s reader to start from zero and buy a first stock.

So if you want to start investing in share market, you’ll love this new guide.

- Step #1. Tools to invest in share market.

- Step #2. How to use trading account?

- Step #3. Why not to be scared of shares.

- Step #4. Why to invest in share market?

- Step #5. Concept of Risk Premium.

- Step #6. Which stocks are good?

- Step #7. Quick Tips: About investing in shares.

- Step #8. Minimum investment in share market.

These are the basic tools necessary to invest in shares (for anybody).

What are these tools?

To buy shares in India, one must have a trading account linked to a bank account and a demat account.

Let’s know more about it:

- Share Trading Account: It is the share trading account using which one actually buy or sell stocks. Every time one need to buy shares, it is here that the person needs to login and do the needful. Without a trading account, one cannot buy or sell stocks. Read: how to open trading account.

- Demat Account: A share trading account cannot work in isolation. It needs a demat account. Like money is stored in banks, shares are kept in demat account. Similarly when shares are sold, they are pulled out of demat account for transaction. Read: how to open a demat account.

- Bank Account: A share trading account also needs a bank account. Trading account is linked to a bank account. When a person buy shares, required amount is automatically debited from this bank account. When a person sells shares, the sale proceed is automatically credited into the bank account. Read: how to open bank account.

Follow the above three steps (A, B & C).

Once the document is uploaded, the bank/DP will conduct a verification.

Upon verification, the login details are generally sent over email (and sometimes also by post).

You can use these login details to enter the trading account and start buying and selling shares.

Generally, trading accounts opening is free of any charges.

The only charges that needs to be paid (brokerage) is when you’ll buy or sell shares. Know more about brokerage here…

But before one can start trading, two more accounts needs to be opened…

1.2 How to open demat account?

The account opening procedure for demat and trading a/c is same.

For beginners, it is better to open a share trading and demat account as a package.

For people who already have a demat account, can simply link their existing demat with new trading a/c.

A demat account is a “dematerialisedaccount” for shares.

“Dematerialised” means, electronic copy of share certificates. These days hard copies of share certificates are not issued.

1.3 How to open bank account?

These days, bank accounts are easy to open.

If one has a Aadhar & PAN card, account opening can be done online -within minutes.

But if one does not have an Aadhar card, account opening may take couple of more steps.

After submission of the above application form, three documents which must be submitted could be these:

Once these three accounts (trading, demat, and bank) are in place, you are ready to invest.

You can login into your trading account and start buying-selling shares online.

Quick Tip: Go for the 3 in 1 account offered by ICICI, Kotak, HDFC, Axis, etc.

The benefit of such account is that, with ONE application form you can open three a/c’s in one go.

At this stage you will also want to know – “how to use a trading account?“

Let’s know more…

Step #2. How to use trading account?

The basic question here is, how to buy and sell shares using trading account.

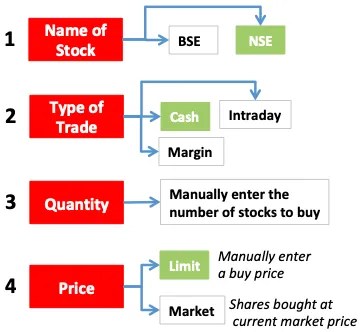

There are four basic things one has to do in a trading account to buy and sell shares:

- Stock Name: Enter the name of stock you want to buy. You’ve to self-decide which stock to buy/sell. Read: How to screen stocks. There are two stock exchanges: BSE and NSE. One can buy stock form any one of them. BSE has more stocks than NSE. By default go for NSE.

- Trade Type: In any share trading platform, there are three types of trades possible: Cash, Intraday, and Margin. A beginner must go with the “cash” options. Intraday and Margin trading is for more professional traders. Read: Why to avoid day trading.

- Quantity: Here one must enter the quantity of shares to buy. How to decide it? Suppose a share “ABC” is Rs.100, and your budget is Rs.5,000. In this case you can buy only 50 nos shares. Remember: brokerage and other charges, taxes will be extra. Read: minimum amount to invest in share market.

- Price: Enter the price at which you want to buy your share. There are two options here: decide your own price, or buy it at a current market price. This step is most critical. Why? Because lower will be price of purchase, higher will be the profits. Read: Significance of low PE stocks.

Let me show you the above four parameters in a real life share trading platform:

Out of all the steps shown above, the most critical step is #4.

As a good stock investor, your target should be to buy shares ONLY at undervalued price levels. Read: about undervalued shares.

Shares are risky, and this risk of loss comes from not knowing “how to value stocks as undervalued or overvalued“.

Having said that, I’ll still say – no need to fear shares…

If one knows how to identify a “good stock”, there is no need to be scared of share market.

Many people are afraid to invest in shares. Why? Because of the risk of loss.

On this issue, I’ll like to raise a point:

“Stocks themselves are not risky” – our lack of know how makes it risky.

So, what is the know-how that we must be aware of?

Knowledge of how to value stocks. Period.

Valuing stocks means what?

Identification of a company with strong business fundamentals, whose shares are available at a fair price (undervalued).

Is it safe to trade stocks online

There are two parts of this question. Let me break it down for more clarity.

- Is it safe to buy stocks?

- Is it safe to buy them “online”?

If one knows how to value stocks – trading is safe.

Trading shares “online” is also safe. Current share trading platforms are much safer than before.

Many people are still not at ease with online money transactions.

These people who are still notinternet savvy – hence theyhesitate to buy shares online.

But the fact is that, buying shares online is simple. If one knows how to read and write emails, buying shares online is as easy.

It is just a matter of first couple of transactions, after that, the hesitation will vanish.

Why people like investing in shares? There are four main benefits of investing in shares, over other options:

4.1 Inherent Price Appreciation

There is an inherent advantage of dealing in shares. Over long term horizon, it’s price only appreciates.

How to confirm this theory?

By looking at the performance of Nifty50 index over last 20 years…

Nifty50 has grown at rate of 13.44% in last 20 years.

What is Nifty50? It is a basket of 50 blue chip stocks of Indian stock market.

If one bought a Nifty50 index in 1999, and held it till today (2019), return earned would’ve been 13.44% p.a.

[P.Note: Between 1999 and 2019, we also had the financial crisis of 2008-09. Still return in 13.44%. Read: About 2008-09 financial crisis.]

What does it mean?

Share market is so designed that – over a long period of time, it will only go up.

Lesson: Just buy equity and hold it for long term (like for 20 years). Read: How long is long term in equity.

4.2 Multiple Ways To Invest In Shares

This is one of the best benefits of shares as an investment vehicle.

There are many excellent investment vehicles built around shares to facilitate its investment.

- Direct Shares: What is explained in step #2 is a procedure of direct investing in shares. A learned investor, likes to invest in stocks directly. What is direct investing? Buying stocks of a particular company. Example: When you are buying stocks of TCS using your trading account, you are buying stocks of TCS directly. Read: About direct equity investment.

- Mutual Funds: Buying mutual fund units is indirect investing in shares. Why it is called indirect? Because here we are buying units instead of shares. A unit of mutual fund is made up of a basket of shares. Read: All about mutual funds.

- ETF’s: Exchange Traded Fund (ETF) is a hybrid of shares and mutual fund. In fact it is 95% like mutual fund and 5% like shares. What makes it like shares? It ability to be traded like stocks. Price of mutual funds change once in a day. But price of shares and ETF’s can change every fraction of a second. Read: About ETF as investment.

- Future & Options: This is another advanced way of indirect investing in shares. F&O’s are basically derivatives of shares. Only trained investors use this option to trade in shares. This method of share investing is very profitable (but only for trained investors). Read: Example of Future Trading.

The above alternatives makes share investing one of the most versatile investment options of all.

4.3 Returns Higher Than Inflation

In point #4.1 above, we have seen how Nifty50 has gives a return of 13.44% p.a. in last 20 years.

In the same time duration, average inflation prevailing in India was approximately 6.36% p.a.

What does it mean?

It means, by simply buying an index fund, and staying invested for long term can help us beat inflation.

If we can learn to invest in direct stocks, the differential return (over inflation) can be even higher. Read: Stock investing for beginners.

4.4 Provides Diversification

Suppose you are an investor whose investment portfolio consists of only insurance products, and other debt plans.

This is a portfolio which is almost risk free.

Hence, you need not bother about diversification. Read: About diversification of portfolio.

But if you need to earn higher returns, there is a hue scope. How?

As your portfolio is equity dry, adding at least 20% equity weight is not bad.

Just this small proportion of equity can enhance your portfolio’s return by 3-4% per annum. Read: About the power of compounding.

Step #5. Concept of Risk Premium

Equity (shares, equity-funds etc) generates higher returns than debt based investments. Why?

Because equity has a quality to generate “risk premium” for its investors.

What is a risk premium? It’s a reward for investors who take calculated risks.

What is calculated risk?

There are two ways of dealing with the concept of “calculated risk” in equity:

- Spread the money: How to do it? Buy an index fund, and stay invested for long term. What are index funds? They are basically a basket of high quality stocks. Why to buy a basket instead of one stock? Because for an untrained eye, evaluating which “one stock” to buy is a tough decision. Hence, the next best alternative is index funds. Read: Index vs active funds.

- Value Investing: What is it? Here the investors target is to identify a “good share”. This is a share whose “business fundamentals” are strong but is currently trading at “undervalued price” levels. The return that can be generated from value investing far exceeds the index investing strategy. But there is a big “limitation”. How to identify a good share? Read: About value investing.

Let’s get more clarity about risk premium.

People who does not want to take risk (investing only in debt), their risk premium is zero.

Investors who want to practice index investing (even a novice can do), their risk premium can be in the range of 4% in long term.

A novice can also earn a high risk premium by investing in mutual funds like multi cap, mid cap, small cap etc. Read: Types of mutual funds and their returns.

In direct stock investing, risk premium can be even higher.

But direct stock investing must be done with care. One cannot invest in shares like in debt and mutual funds.

So, let’s see how a novice can learn to find good stocks…

Step #6. Which stocks are good?

To invest in share market successfully, one must know WHICH are good stocks for investing.

How we generally locate good stocks?

“We look for stocks which experts are advising to buy on TV and Newspapers.”

This is not a proper way of picking good stocks. Why?

Because of two reasons:

- #1. Technical Picks: Most of these advise are technical in nature. It has concentration more on “price” than on business fundamentals. Hence, chances of failure is high. Read: Technical analysis for long term investors.

- #2. Short Term Picks: On one side technical picks are risky because of its myopic view on price movements. On other side, the life of these advices are too short. If you bought such a stock, and forgot to track its movement for next 2-3 months, its price can go anywhere. Read: Penny stocks having strong fundamentals.

6.1 Which is the proper way of picking good stocks?

So, the rule of successful investing in shares is, “NOT to depend on outside advice“.

Build your own stock screening criteria. You will be surprised – it is not so difficult as you thought.

How to do it?

- Step 1 – Prepare a list of fundamentally strong stocks.

- Step 2 – Buy only undervalued stocks from the list.

Let’s know more about it…

- Fundamentally strong stocks: Generally speaking, these are stocks of companies whose sales, net-profit, EPS, and Reserves are increasing year after year. The company’s ROE and RoCE is higher than its competitors. In the past 7-10 years, the company’s free cash flow is positive. Read: About fundamentally strong stocks.

- Undervalued Stocks: There are two ways to identify undervalued stocks. Best way: By estimation of its intrinsic value. Alternative way: by calculating its financial ratios. Though intrinsic value estimation is a more assured way to value stocks. Read: about intrinsic value formula.

Step #7. Quick Tips: About Investing in Shares

With advent of technology, putting money in stock market has become easy.

This is also one reason why, bad investments are happening too often.

But on the other side, good information about stocks are also available for free.

For an investor, it has becomes easier to get access to reliable information about stocks from internet.

In addition to this, one can follow the belowproceduresto invest in stocks successfully.

- Have Clear Goals: To ensure effective stock investing, one must clearly spell out the ‘goals’ first. Before buying the first stock, the person must know why he/she is buying that stock in first place. Defining clear and quantifiable goal is a key. Never buy a stock without assigning a purpose/goal to it. Read: Aboutgoal based investments.

- Expect Realistic Returns: Investing in shares can fetch high returns. But it is also essential to expect rationally. On an average, a reasonably good share can fetch a 12% p.a return (in India). Some stocks can fetch more, and some will fetch less. So, on an average – expecting returns in range of 10% to 15% will be realistic. Read: high return stocks.

- Use of Free Cash: Invest only free cash in shares. What is free cash? Extra money, which, even if is lost, will not disturb your peace of mind. This money can be as low as Rs.500. Evaluate your own “free cash level” and set it as a budget for each month. Use only this budgeted free cash to invest in share market. Read: Tricks to save money.

- Build Stock List: Never buy stock randomly. Always buy stocks from your watch list. How to build this list? Add to the list those shares which you think are good. When to buy? When price of these stocks fall by more than 8-10%, it can be a buy time. But before buying them do a final check on these stocks. How to do final check. You can use my stock tool. Read: Building stock tracker in Google Finance.

What is theminimum amount to invest in share market?Once a friend asked me this question.

Why this question?

There are shares which trade at Rs.50 in share market. Is it ok to buy one number of such shares?

It will cost only Rs.50, right? Is it ok to buy shares with such a low amounts?

8.1 Minimum Amount:

In share market there is nothing called minimum limit. One can buy a Rs.50 shares if one wants.

From market side there are no limitations.

But from investors side, one must keep a watch on the trading expenses.

Purchase of stocks in small amounts may also lead of high cost. How?

8.2 About Brokerage Fee

Different brokers (DP’s) charge different brokerage fee.

Brokerage is charged for each transaction.

For every buy-sell order placed by the investors one needs to pay a specific brokerage fees to the broker .

The level of brokerage fees varies from broker to broker.

Example: Brokerage Charges…

| Name | Brokerage |

| Zerodha | Rs 20 or 0.01% whichever is lower. |

| SAS Online | Rs 9 per trade or 0.07% per trade. |

| HDFC Security | Higher of Rs.25 or 0.25% |

The amount of brokerage one pays on transactions, affect the net profit.

Even if you are investing only Rs.50, a“minimum brokerage per trade”will be applicable.

So in order to maintain a healthy profits there is a minimum investment in share market that must be known.

Let’s see how to estimate minimum investment…

Example: Brokerage Rate @ Higher of Rs.25 or 0.25%

Explanation…

- Investment of Rs.56.8: This amount is used to buy one share of JK Tyre. Brokerage rate is “higher of Rs.25 or 0.25%”. Hence applicable brokerage on investment of Rs.56.8 will be Rs.25 (which is 44% of Rs.56.8). Hence we can conclude that, Rs.56.8 is not an economical amount to invest.

- Investment of Rs.9,769: This amount is used to buy 172 share of JK Tyre. Applicable brokerage on investment of this amount will be Rs.25 (which is ~0.25% of Rs.9,769). Above this amount, the brokerage paid (as % of basic cost of share) remains constant. Hence we can conclude that, Rs.9,769 is a minimum amount to invest at the given brokerage rate.

What we can learn from this calculation?

Note the brokerage rate you are paying on your share trades.

Makes a similar table for yourself as shown above.

Follow the explanations, and check what is the minimum investment in share market for YOU.

Idea is to find a minimum amount at which you pay the minimum brokerage.

Another example: How brokerage effects net profit

Suppose one has funds of $340 to invest in shares. He bought shares of company which was trading at $34/share.

This way he bought 10 number of these shares (10@$34=$340).

After share purchase, suppose the share price goes up to $37.4.

At this price level, on redeeming, he will earn $3.4 profit per share.

This is a gain of approx. 10% (gross).

Suppose the brokerage fee that was paid is $10 per transaction. Here there were two transactions (buying and selling).

With this cash-out of brokerage fees, lets see how the profitability changes:

Calculations…

- Number of shares = 10 Nos

- Market Price of Share = $34.0

- Value invested = $340.0

- Selling Price of Share = $37.4

- Total Price (Sold) = $374

- Gain = $34

- Brokerage Paid during Purchase = $10 (minimum payment)

- Brokerage Paid during selling = $10 (minimum payment)

- Net Gain = $14

- Net Gain % = $14/ 340x 100 = 4.12%.

The market price of share has increased by 10% (from $34 to $37.4), but due to the brokerage fee (minimum payment) the net gain was limited to 4.12%.

The lower will be the invested value, more severe will be the effect of brokerage fees.

Conclusion

Investing in share market can be both easy and tricky at the same time.

How it is easy?

Because these days opening a trading account and buying your first shares can be done within a matter of few days.

How it is tricky?

Because finding which stock to invest-in, is not easily identifiable as we may think.

So, what is the right step forward?

Do not buy your first stock till you have a clear understanding of step #6 and step #7 (shown above).

You can also check my stock tool which has been designed to make the process of shares analysis easy.

I hope you like this detailed article on how to invest in shares. In case you have some feedback/queries on this topic, kindly put it in the comment section below. I’ll be delighted to read your point of view on the subject.

Have a happy investing.

< Back

Next >