What kind of savings account should I open?

High-yield savings accounts are a type of savings account offering an APY that's much higher than that of a traditional savings account. In recent years they've become increasingly popular as the Federal Reserve has raised rates several times in its attempt to lower inflation.

High-yield savings accounts are a type of savings account offering an APY that's much higher than that of a traditional savings account. In recent years they've become increasingly popular as the Federal Reserve has raised rates several times in its attempt to lower inflation.

| Bank | Interest Rate of Savings Bank Account | Minimum Balance |

|---|---|---|

| Kotak Mahindra | 3.50% - 4.00% | Rs.10,000 |

| RBL Bank | 4.25% - 6.75% | Nil, Rs.1,000, Rs.10,000, or Rs.25,000, depending on the type of account |

| IndusInd Bank | 3.50% - 6.00% | Nil to Rs.20,000, depending on the type of account |

- Evergreen Bank Group – 5.25% APY.

- CFG Bank – 5.25% APY.

- North American Savings Bank – 5.24% APY*

- Popular Direct – 5.20% APY.

- EverBank (formerly TIAA Bank) – 5.15% APY.

- RBMAX – 5.15% APY.

- Bread Savings – 5.15% APY.

- Western State Bank – 5.15% APY.

- Pick a type of savings account.

- Determine if you want an online-only account.

- Evaluate the account fees.

- Consider annual percentage yield (APY).

- Look at the other accounts offered.

- Interest Rates Can Vary. Interest rates for both traditional and high-yield savings accounts can vary along with the federal funds rate, the benchmark interest rate set by the Federal Reserve. ...

- May Have Minimum Balance Requirements. ...

- May Charge Fees. ...

- Interest Is Taxable.

No financial institutions currently offer 7% interest savings accounts. But some smaller banks and regional credit unions are currently paying more than 6.00% APY on savings accounts and up to 9.00% APY on checking accounts, though these accounts have restrictions and requirements.

| Bank | Forbes Advisor Rating | Products |

|---|---|---|

| Chase Bank | 5.0 | Checking, Savings, CDs |

| Bank of America | 4.2 | Checking, Savings, CDs |

| Wells Fargo Bank | 4.0 | Savings, checking, money market accounts, CDs |

| Citi® | 4.0 | Checking, savings, CDs |

Keeping all of your emergency funds in a savings account is generally advisable as well since it may be easier to spend it on things other than emergencies if it's sitting in a checking account.

Savings Account. Aim for about one to two months' worth of living expenses in checking, plus a 30% buffer, and another three to six months' worth in savings.

Is it smart to open a savings account?

For the most part, yes. Even if you have a very small amount of money (just a buck or 2 will do), you can use a savings account to keep it safe while earning interest.

Use NerdWallet's savings calculator to estimate your balance over time. With a 4% APY, a savings balance of $1,000 would earn about $41 after a year. It may not make you rich, but the earnings are much better than in an account with an APY of, say, 0.50%, which would earn about $5 during the same time period.

Opening a savings account does not impact your credit score because you aren't borrowing money and the activity in your savings account isn't reported to a credit agency. Most financial institutions will run a soft credit inquiry when you open a savings account but it is only to check your identity.

- Regular savings account: earns interest and offers quick access to funds.

- Money market account: earns interest and may provide check-writing privileges and ATM access.

- Certificate of deposit, or CD: usually has the highest interest rate among savings accounts, but no access to funds.

Many banks require a minimum initial deposit, often from $25 to $100, but others have no minimum deposit requirement. Even if you don't have to fund your account when you first open it, you're better off depositing money sooner rather than later. That way, you'll be able to start earning interest sooner.

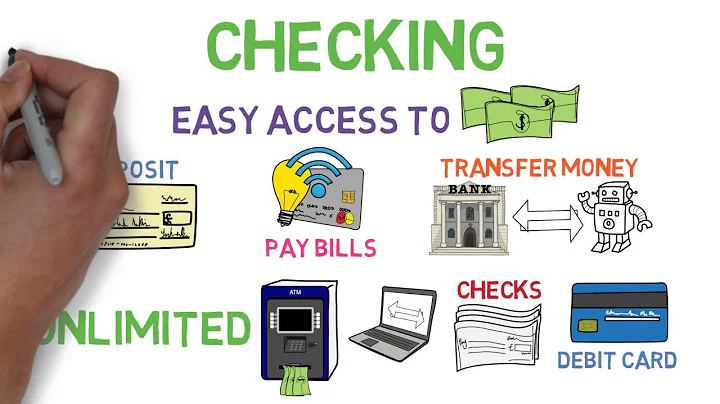

But you don't have to choose between the two. It's often beneficial to have a both a checking and savings account. Having multiple bank accounts can help with your daily and long-term finances.

Your money is invested, so the balance can go up and down with regular market activity. High-yield savings accounts, on the other hand, are not tied to the stock market. As such, the risk of losing money is extremely low. Even if your financial institution fails, FDIC insurance can cover a large portion of your losses.

Disadvantages of Savings Accounts

Inflation might erode the value of your savings. Some financial institutions require a minimum balance to earn the highest interest rate. Some accounts might charge fees.

U.S. government securities–such as Treasury notes, bills, and bonds–have historically been considered extremely safe because the U.S. government has never defaulted on its debt. Like CDs, Treasury securities typically pay interest at higher rates than savings accounts do, although it depends on the security's duration.

Do You Have to Pay Taxes on Your High-Yield Savings Account? You only have to pay taxes on the interest you earn on a high-yield savings account—not on the principal balance. High-yield savings account interest is taxed at ordinary income tax rates.

Where can I get 10% interest on my money?

- Stocks.

- Real Estate.

- Private Credit.

- Junk Bonds.

- Index Funds.

- Buying a Business.

- High-End Art or Other Collectables.

At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. This is called the 50/30/20 rule of thumb, and it provides a quick and easy way for you to budget your money.

Over a few weeks in the spring of 2023, multiple high-profile regional banks suddenly collapsed: Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank. These banks weren't limited to one geographic area, and there wasn't one single reason behind their failures.

Following one of the most successful years in United's long history, United Bank has been named the Most Trustworthy Bank in America by Newsweek for 2023.

- JPMorgan Chase.

- U.S. Bank.

- PNC Bank.

- Citibank.

- Wells Fargo.

- Capital One.

- M&T Bank Corporation.

- AgriBank.