What does it mean when a crypto is oversold?

What Is Oversold? Oversold is a term used to indicate that an asset such as Bitcoin is trading at a price lower than its true value. Oversold is the opposite of overbought. Therefore, whether an asset is treading the oversold region is subjective since analysts employ different analysis tools.

Even if a stock or other asset is a good buy, it can remain oversold for a long time before the price starts to move higher. This is why many traders watch for oversold readings, but then wait for the price to start moving up before buying based on the oversold signal.

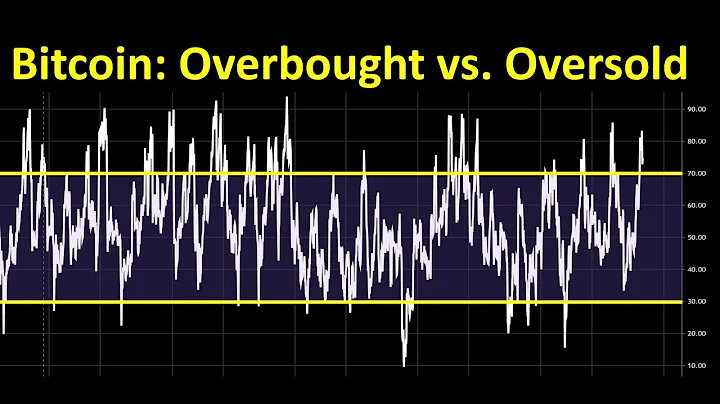

The Relative Strength Index (RSI) is a momentum indicator that evaluates overbought or oversold conditions by measuring the magnitude of recent price changes for various assets. The index was introduced in 1978 by technical analyst J. Welles Wilder Jr. in his book New Concepts in Technical Trading Systems.

Overbought means an extended price move to the upside; oversold to the downside. When price reaches these extreme levels, a reversal is possible. The Relative Strength Index (RSI) can be used to confirm a reversal.

Overbought is a term used to describe a phenomenon where a cryptocurrency price increases over time due to continued investments, but without a supporting investment rationale. Usually, a selling period follows an overbought condition.

Tip. Overbought and oversold stocks are those that analysts see as not trading for their true worth. An overbought stock may be selling for more than it's worth, while an oversold stock may be worth more than its current trading price.

The term 'oversold' refers to when an investor believes a stock is being sold 'too much' among traders for numerous reasons. Unlike a market correction (falling 10%), or turning bear (falling 20%), there is no number or threshold that can confirm when a stock has been oversold.

One of the worst “rookie mistakes” of technical analysts is to think of overbought as bad and oversold as good. When a stock is overbought with an RSI above 70, all that means is that the price has gone up a lot - that's it. On its own, this doesn't suggest negativity, but tells you the uptrend has been strong.

The most popular indicators used to identify overbought and oversold conditions are the relative strength index (RSI) and the stochastic oscillator. Both tools are momentum indicators and are plotted on a separate graph adjacent to that of the price action.

Crypto traders often read overbought/oversold RSI readings with blockchain metrics like whale demand, derivatives market data and macro factors.

What does RSI 50 mean?

Traditionally, RSI readings greater than the 70 level are considered to be in overbought territory, and RSI readings lower than the 30 level are considered to be in oversold territory. In between the 30 and 70 level is considered neutral, with the 50 level a sign of no trend.

An RSI reading of 30 or below indicates an oversold or undervalued condition. During trends, the RSI readings may fall into a band or range. During an uptrend, the RSI tends to stay above 30 and should frequently hit 70.

- Create a live trading account or a risk-free demo account.

- Choose a market to trade.

- Use the RSI or stochastic oscillator to identify overbought and oversold conditions.

- Decide whether to go long or short.

- Open your position, monitor the trend and close your trade.

The calculation is based on the most recent 14 periods, one candle represents one period. The RSI indicator crypto shows when a market is overbought or oversold. Usually, a number above 70 indicates that the market is overbought, and below 30 means that it is oversold.

When an asset reaches an overbought level, it means extreme price movement upside from where the reversal is highly expected. Conversely, the oversold level indicates a possible reversal point after an extreme bearish pressure in the price.

Relative strength index (RSI) is a momentum indicator that indicates overbought or oversold situations of an asset or cryptocurrency. Simply put, RSI is an oscillator that calculates high and low bands between two opposite values, while estimating the magnitude of price variation and the speed of these variations.

A high-risk investment is one for which there is either a large percentage chance of loss of capital or under-performance—or a relatively high chance of a devastating loss.

Sometimes certain stocks will remain overbought (at 80 or 90) not for days or weeks, but for months. The longer the stock remains overbought without reversing, the less effective the oscillator. In addition, like many indicators, RSI is not as successful in a low-volatile market environment.

The relative strength index (RSI) provides short-term buy and sell signals. Low RSI levels (below 30) generate buy signals. High RSI levels (above 70) generate sell signals.

Meanwhile, BTC appears to be oversold on the charts, which typically precedes a short-term upswing in price. "All About Bitcoin" host Christine Lee breaks down the Chart of the Day.

What are crypto whales buying now?

Shiba Inu Whales Buy More SHIB Tokens

Etherscan, a platform that tracks transactions made by large holders, unleashed that in the last few weeks, crypto whales have bought over 200,588,182,473 Shiba Inu tokens.

Top Bitcoin whales have been buying the dip, adding over 6,000 BTC in a day, according to analysts. It appears that the largest Bitcoin wallets are buying the dip during the current market pullback, adding upwards of 6,000 BTC in a day.

As you can see, the indicator appears below the chart and is made up of a single line that moves between two levels – 0 and 100. In the middle of the chart is the 50 level. The relative strength index (RSI) is an oscillating indicator that shows when the market may be overbought or oversold.

MACD is a trend-following momentum indicator that is part of the oscillator family of technical indicators. It allows you to: Assess the current trend direction (bullish or bearish) and predict where the price is more likely to go, based on the relationship between two moving averages.

The acronym RSI stands for Relative Strength Index, which is, in essence, a technical analysis (TA) indicator that measures the strength and velocity of price oscillations. As such, the RSI is a momentum oscillator that examines the magnitude and speed of the market movements. J.

As mentioned before, the normal default settings for RSI is 14 on technical charts. But experts believe that the best timeframe for RSI actually lies between 2 to 6. Intermediate and expert day traders prefer the latter timeframe as they can decrease or increase the values according to their position.

Bollinger Bands are envelopes plotted at a standard deviation level above and below a simple moving average of the price. Because the distance of the bands is based on standard deviation, they adjust to volatility swings in the underlying price. Bollinger Bands use 2 parameters, Period and Standard Deviations, StdDev.

What does RSI 14 mean? The default RSI setting for the RSI indicator is 14-periods. That means the indicator is calculated using the last 14 candles or last 14 bars on the price chart. Using a shorter timeframe, for example 5-periods will cause the RSI reach extreme values (above 70 or below 30) more often.

The most popular indicators used to identify overbought and oversold conditions are the relative strength index (RSI) and the stochastic oscillator. Both tools are momentum indicators and are plotted on a separate graph adjacent to that of the price action.

“Overbought” is when a security makes an extended move to the upside (and is trading higher than its fair value). “Oversold,” conversely, is when a security makes an extended move to the downside (and is trading lower than its fair value).

What does it mean if a stock is strongly sold?

A strong sell is a type of stock trading recommendation given by investment analysts for a stock that is expected to dramatically underperform when compared with the average market return and/or return of comparable stocks in the same sector or industry. It is an emphatic negative comment on a stock's prospects.

Key Takeaways. An overweight rating on a stock usually means that it deserves a higher weighting than the benchmark's current weighting for that stock. An overweight rating on a stock means that an equity analyst believes the company's stock price should perform better in the future.

One of the worst “rookie mistakes” of technical analysts is to think of overbought as bad and oversold as good. When a stock is overbought with an RSI above 70, all that means is that the price has gone up a lot - that's it. On its own, this doesn't suggest negativity, but tells you the uptrend has been strong.

The Relative Strength Index or RSI is one of the most common indicators in Technical Analysis, or TA for short. In traditional stocks and cryptocurrencies like Bitcoin and Ethereum, TA utilizes existing data to make more informed decisions on when to buy and sell for traders.

- Create a live trading account or a risk-free demo account.

- Choose a market to trade.

- Use the RSI or stochastic oscillator to identify overbought and oversold conditions.

- Decide whether to go long or short.

- Open your position, monitor the trend and close your trade.

The calculation is based on the most recent 14 periods, one candle represents one period. The RSI indicator crypto shows when a market is overbought or oversold. Usually, a number above 70 indicates that the market is overbought, and below 30 means that it is oversold.

Crypto traders often read overbought/oversold RSI readings with blockchain metrics like whale demand, derivatives market data and macro factors.

When an asset reaches an overbought level, it means extreme price movement upside from where the reversal is highly expected. Conversely, the oversold level indicates a possible reversal point after an extreme bearish pressure in the price.

A stochastic value of 80 or above is considered an indication of an overbought status, with values of 20 or lower indicate oversold status.

To be sure the breakout will hold, on the day the stock price trades outside its support or resistance level, wait until near the end of the trading day to make your move. Set a Reasonable Objective: If you are going to take a trade, set an expectation of where it is going.

When can you say that it is a high risk buying opportunity?

A high-risk investment is one for which there is either a large percentage chance of loss of capital or under-performance—or a relatively high chance of a devastating loss.

An Underweight stock rating indicates to investors that it may not be a good investment. In other words, if a stock is rated by Wall Street financial analysts as an Underweight stock, it is expected to have a lower return than other stocks in its market sector.

A long-term investor looking to maximize profits over a long period of time may be willing to hold stocks that generate lower than average returns in the short term, in order to avoid paying higher tax rates and additional transaction fees. Investors should not take underweight ratings too literally.

Overweight is a buy recommendation that analysts give to specific stocks. It means that they think the stock will do well over the next 12 months.