Can speculators make money?

Speculators seek quick profits, usually by predicting the direction of prices. In theory, it can work out well. If you predict the price of an asset will rise over a short period of time and it does, then it may be much more profitable than if you bought the asset and held it for the long haul.

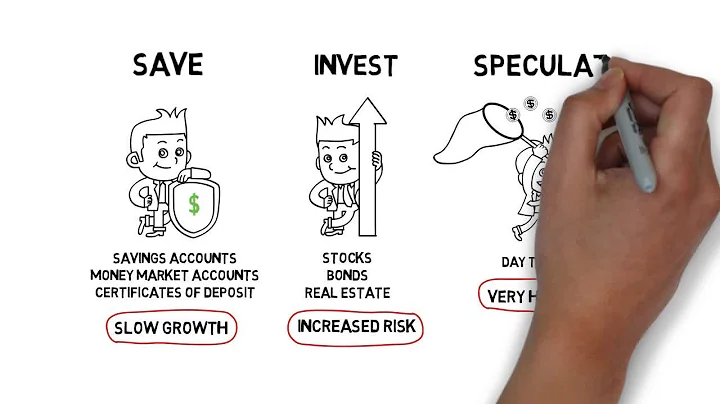

Speculation involves investing in assets with the hope of big gains but the chance for a major loss. Investors can speculate on their positions when they make investments in a variety of assets, including stocks, real estate, and other risky ventures.

Speculators generally buy assets for a short period in the hopes of selling them for a profit after a dramatic price increase. They may be active in the stock market and bond market, as well as less traditional investment markets such as trading currencies (forex), cryptocurrencies, and commodities.

A very beneficial by-product of speculation for the economy is price discovery. On the other hand, as more speculators participate in a market, underlying real demand and supply can diminish compared to trading volume, and prices may become distorted.

Gambling refers to wagering money in an event that has an uncertain outcome in hopes of winning more money, whereas speculation involves taking a calculated risk with an uncertain outcome. Speculation involves some sort of positive expected return on investment—even though the end result may very well be a loss.

Stock traders are also called speculators of the market as they tend to enter and exit in a short span. Traders can be individuals working on their own or professionals working for a financial company. The greatest three traders in the history of trading are George Soros, Michel Burry, and David Tepper.

Well, there is no limit to how much you can make from stocks in a month. The money you can make by trading can run into thousands, lakhs, or even higher. A few key things that intraday profits depend on: How much capital are you putting in the markets daily?

Trading is often viewed as a high barrier-to-entry profession, but as long as you have both ambition and patience, you can trade for a living (even with little to no money). Trading can become a full-time career opportunity, a part-time opportunity, or just a way to generate supplemental income.

Making some trades to appease social forces is not gambling in and of itself if people actually know what they are doing. However, entering into a financial transaction without a solid investment understanding is gambling. Such people lack the knowledge to exert control over the profitability of their choices.

If you're a consumer, however, you probably don't like speculators as much. Speculators often drive commodity prices higher and that can lead to higher prices for consumers. That's why you'll often hear politicians railing against speculators for pushing up the prices of gas or food.

What is the sin of speculation?

The Catechism of the Catholic Church identifies “speculation in which one contrives to manipulate the price of goods artificially in order to gain an advantage to the detriment of others” as “morally illicit” (CCC #2409)..

Speculation that is disseminated yet is wrong does no harm apart from irritating a few people who are so unimaginative that they do not know how to speculate. Speculation that is broadly correct but is suppressed can lead to the crippling of innovation.

Financial market failures include market rigging, speculative bubbles, information failures and low levels of market competition between suppliers.

Key Takeaways

Speculators are important to markets because they bring liquidity and assume market risk. Conversely, they can also have a negative impact on markets, when their trading actions result in a speculative bubble that drives up an asset's price to unsustainable levels.

- Bull Speculator. People who are bull speculators anticipate an increase in the asset's price. ...

- Bear Speculator. Bears can be known to be the opposite of the first category of speculative individuals we discussed, the bulls. ...

- Lame Duck. ...

- Stag.

An investor who purchases a speculative investment is likely focused on price fluctuations. While the risk associated with the investment is high, the investor is typically more concerned about generating a profit based on market value changes for that investment than on long-term investing.

Financial speculation is frequently considered unethical because people don't think about the service provided by such financial speculation.

While all stock trading has some degree of speculation, speculative trades have an especially high impact within financial markets. Speculative trades are trades that involve companies that, for some reason, have a high risk/high reward profile.

Speculators are vulnerable to both the downside and upside of the market; therefore, speculation can be extremely risky. But when they win, they can win big—unlike hedgers, who aim more for protection than for profit. If hedgers can be characterized as risk-averse, speculators can be seen as risk-lovers.

Results indicated motivational reasoning as the prime cause for speculative activities. Evidence indicated that land speculation is a critical dynamic for self-worth especially with business-oriented persons.

Why do we need speculators?

Speculators provide the markets with liquidity, aid in price discovery, and take on risk that other market participants wish to unload. In commodities markets, speculators also keep markets efficient and stave off shortages of goods by bidding them up when prices fall and financing the middlemen who link supply chains.

You're really probably going to need closer to 4,000 or $5,000 in order to make that $100 a day consistently. And ultimately it's going to be a couple of trades a week where you total $500 a week, so it's going to take a little bit more work.

$3,000 X 12 months = $36,000 per year. $36,000 / 6% dividend yield = $600,000. On the other hand, if you're more risk-averse and prefer a portfolio yielding 2%, you'd need to invest $1.8 million to reach the $3,000 per month target: $3,000 X 12 months = $36,000 per year.

Becoming a Stock Market Millionaire Is Indeed Possible, but It Requires a Combination of Strategic Thinking, Risk Management, and a Long-Term Perspective. It's About Planting the Seeds of Investment and Patiently Nurturing Them as They Grow into Mighty Oaks.

Imagine a small trading account of $1,000. When we risk 2% - $20, how big profits can we expect? If we consider the 1: 1 fixed money management rule, we can expect earnings around $20 per trade. In order to reach the average monthly salary ($1,500), you need 75 profitable trades.