As the meat of earnings season begins, it’s worth noting what investors have learned so far. The short version is, apart from a few isolated companies (cough, Netflix, cough), not a whole lot: the projected rise in S&P 500 earnings per share this year stands at 8.9%, compared with 8.1% at end of March, according to S&P Global Market Intelligence.

But even as expectations toward earnings have improved, the market has struggled, with the S&P 500 SPX,

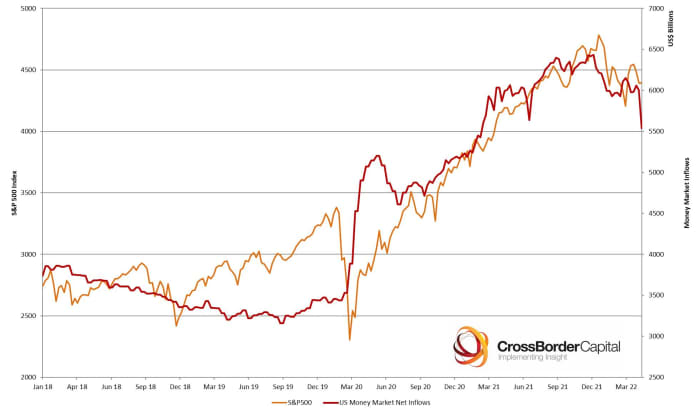

Well, reserves at the Fed fell by $460 billion last week, which according to Citigroup was the biggest weekly drop ever. So let’s hear what that means from Michael Howell, dubbed the godfather of global liquidity, and the chief executive of CrossBorder Capital, a boutique he formed in 1996 after heading the research teams at Baring Securities and Salomon Brothers. Howell explained to Jack Farley of Blockworks Macro that, by global liquidity as opposed to market liquidity, he means the ability to change investment positions relatively easily. “If you put more liquidity into a financial system, what’s happening is you are decreasing systemic risks, because it’s much easier for any particular entity to get funding, and if funding is easy, people will move along the risk curve into higher risk instruments,” he said.

The central banks, through monetary operations, control a large part of liquidity. He also monitors the actions of commercial banks, shadow banks, big corporations such as Microsoft and Alphabet and cross-border investors. And in response to surging inflation, some 95% of central banks around the world are tightening. The Federal Reserve, in the minutes from the last Federal Open Market Committee meeting, outlined a plan to reduce its balance sheet by some $2 trillion.

Howell says a normal tightening cycle would lead the S&P 500 down by around 15%, if a recession is thrown on top that’s a 30% drop, and if there’s a banking crisis on top of that, there’s a 50% slide. “I don’t think we’re going to get the third, I think we’re getting more than the first, so I’m plumbing for the middle which is about a 30% correction from the peak to the low,” he said.

Since there’s already about 10% of the decline from the peak, Howell says there’s another 20% drop to come.

“The point to remember about the financial system is that, contrary to what the economics profession says and the economic textbooks spell out, the financial system is much less a new financial system than it is in reality a refinancing system,” says Howell. With some $300 trillion of global debt and the average maturity about five years, some $60 trillion needs to refinanced every year.

That declining liquidity has already been seen with the collapse in the Japanese yen USDJPY,

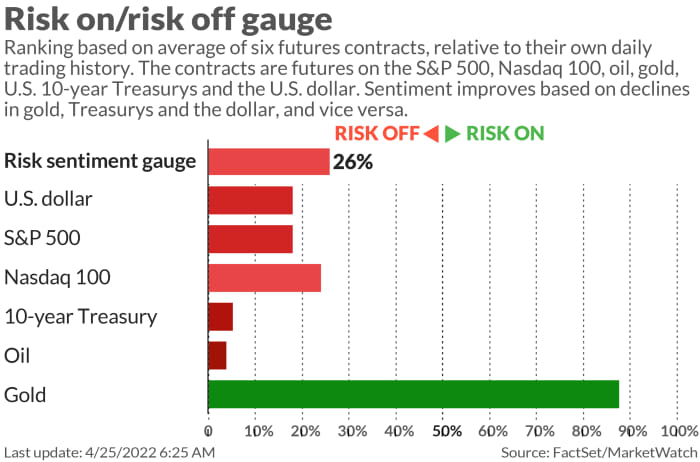

Howell also said that market leadership — utilities and brand names outperforming cyclicals and techs — and the yield curve are saying that investors want safety and that a recession is increasingly likely.

The buzz

Twitter’s TWTR board has suddenly warmed to Elon Musk’s bid now that it has financing, The Wall Street Journal reported, citing people familiar with the matter. Bloomberg News said talks are in the final stretch.

China’s capital of Beijing appears to be moving toward the strict lockdowns seen in the financial hub of Shanghai in response to a new COVID-19 outbreak.

The European Parliament and European Union member states over the weekend agreed on a proposed Digital Services Act, that will force tech companies to take more responsibility for the content on their platforms.

French President Emmanuel Macron comfortably defeated his far-right challenger, Marine Le Pen. The German Ifo business climate index edged up in April from a 14-month low in March.

The People’s Bank of China said it’s cutting foreign exchange reserve requirements by a full point, after a recent surge in the dollar vs. the yuan USDCNY,

Coca-Cola KO,

The market

U.S. stock futures ES00,

Crude-oil CL.1,

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, | Tesla |

| GME, | GameStop |

| AMC, | AMC Entertainment |

| NIO, | Nio |

| TWTR | |

| NFLX, | Netflix |

| AAPL, | Apple |

| NVDA, | Nvidia |

| CENN, | Cenntro Electric |

| MULN, | Mullen Automotive |

Random reads

There’s now a bar that only shows women’s sports.

This Japanese man married a fictional character.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

As a seasoned expert in financial markets and economic analysis, I bring a wealth of experience to dissect and interpret the complex dynamics at play in the current financial landscape. With a background that includes leadership roles at prestigious institutions such as Baring Securities and Salomon Brothers, coupled with founding and heading the research teams at CrossBorder Capital since 1996, I have a comprehensive understanding of global liquidity and its impact on market trends.

Now, delving into the content of the provided article, several key concepts come to light:

-

Earnings Season Overview: The article opens with a discussion about the ongoing earnings season, highlighting that, apart from a few exceptions like Netflix, the projected rise in S&P 500 earnings per share stands at 8.9%. Despite this positive outlook, the market has experienced a 6% decline in the S&P 500 this month.

-

Fed Reserves and Global Liquidity: A significant factor influencing the market is the notable decrease in reserves at the Federal Reserve by $460 billion, the largest weekly drop ever recorded. The article turns to insights from Michael Howell, identified as the "godfather of global liquidity," who explains that global liquidity, in contrast to market liquidity, refers to the ease of changing investment positions. Increased liquidity generally decreases systemic risks by making funding more accessible.

-

Central Banks and Tightening Measures: The piece discusses the response of central banks worldwide to surging inflation, with approximately 95% of them tightening. The Federal Reserve, in particular, is planning to reduce its balance sheet by $2 trillion, a move that could impact market dynamics significantly.

-

Market Correction Predictions: Michael Howell provides his perspective on the potential market correction. He suggests that a normal tightening cycle could lead to a 15% decline in the S&P 500, with the possibility of a 30% drop in the case of a recession and a 50% slide in the event of a banking crisis. Howell leans towards a 30% correction, indicating that there might be another 20% drop to come.

-

Financial System as a Refinancing System: Howell emphasizes an unconventional view of the financial system, stating that it operates more as a refinancing system than a new financial system. With $300 trillion of global debt and an average maturity of about five years, there is a constant need to refinance, and declining liquidity is already evident in the financial markets.

-

Market Indicators: The article touches upon market indicators such as the leadership shift towards utilities and brand names over cyclicals and tech stocks. It also mentions signals from the yield curve, suggesting that investors are seeking safety, and there is an increasing likelihood of a recession.

-

Other Market News: The article provides a brief roundup of other market-related news, including updates on Twitter's response to Elon Musk's bid, developments in China's COVID-19 response, and the agreement on a proposed Digital Services Act in the European Union.

In conclusion, my in-depth knowledge of financial markets allows me to navigate and decipher the nuanced information presented in the article, providing a comprehensive understanding of the current economic landscape and its potential implications for investors.