This post contains affiliate links; we may earn a commission if products or services are utilized.

Supplemental loans have often been forgotten by borrowers financing apartment buildings. A decreasing interest rate environment has made them largely irrelevant. Tactica's underwriting model, which can model supplemental loan proceeds, is probably one of the least utilized components of the financial model.

I plan to explain the nuances of supplemental financing, show you an instance where it may be helpful, and demonstrate their impact on underwriting. I have a nagging suspicion that they will become more prevalent in commercial real estate over the next decade, especially in multifamily, senior housing, and potentially student housing.

Supplemental Loan Contents

Agency Financing Primer

What is a Supplemental Loan?

Supplemental Mortgage Advantages

Capital Stack Example

Challenges of Underwriting Supplemental Loans

Future Economic Outlook

Assumption Financing (Supp. vs. No Supp.)

Agency Financing Primer

For more significant multifamily properties, agency financing options such as Fannie Mae and Freddie Mac have been trendy for borrowers. Fixed-rate interest rates are low; long amortization terms are standard, maximum LTV can get as high as 80%, and non-recourse is almost certain (with the standard carve-outs for fraud and deceit).

In 2021,Fannie and Freddie will purchase up to $140 billionin multifamily loans from qualified lending partners, down from previous years but still a massive number. It's also important to note that 50% of this cap has to be earmarked toward mission-driven affordable housing.

What is a Supplemental Loan?

The simplest definition of supplemental financing is:

Adding a smaller subordinate debt tranche to the original loan balance.

A supplemental loan is not the same as refinancing the property. You're taking out a second loan in addition to the current mortgage.

For example, you have $20 million outstanding on a 10-year Fannie Mae loan with seven years left until the loan balloons. You could ask your lender for an additional $2 million tranche that is subordinate to the first loan and expires simultaneously as the first mortgage (it's coterminous). The interest rate will likely be higher than the first loan (as it's riskier and lower on the totem pole if there's a borrower default) and could have a floating rate.

Related: Why forecasting future interest rates based on the forward SOFR curve is dangerous.

I usually see supplemental prices that are about 100 basis points higher than the first loan and have a 1% origination fee. They've always had a fixed rate, in my experience.

Supplemental Financing Mortgage Advantages

Let's say you are looking to purchase a property. You call ownership groups in your submarket of interest, and one particular owner is interested in selling. A few problems:

They just opted to refinance 1.5 years ago due to lucrative debt markets and securing a cheaper interest rate.

The yield maintenance (a common form of prepayment penalty) is significant. The owner would be on the hook to pay their lender millions in yield maintenance fees if they were to sell and liquidate the loan.

A few other project-specific tidbits:

Your asset pricing is coming out at $25 million.

The current loan balance on this property is $16.5 million.

The interest rate is 3.5%.

So the owner says to you, "Would you assume the financing? If not, I cannot sell you this deal. The prepayment penalties would eat into all my profits."

You ponder it, but it puts you in a difficult position. The current loan-to-value is only 66% (16.5 / 25)

You only have about $6.5 million in committed equity, which is far below the current spread of $25 million minus $16.5 million ($8.5 million)

The supplemental tranche is a way to close this gap.

You could negotiate a supplemental financing tranche for $2 million with the lender.

Capital Stack Example

First Loan Assumption: $16.5 Million

Supplemental Loan: $2.0 Million

Investors Equity: $6.5 Million

Total Sources: $25.0 Million

The lender must vet you personally and ensure that this increased debt burden still allows property operations to comply with the debt service coverage ratio (DSCR) or debt yield. But thankfully, the lender will already be familiar with the property and likely have specific documentation on file, such as a phase I environmental, a property condition report, and any other 3rd party reports.

Ultimately, the seller could unload a property and avoid crippling prepayment fees. The buyer got the property and assumed the mortgage with solid loan terms. The lender originates another small loan on a property they're already familiar with. Everybody wins.

Challenges of Underwriting Supplemental Loans

Over the past decade, the interest rate environment has made this execution nearly impossible.

Interest Rates

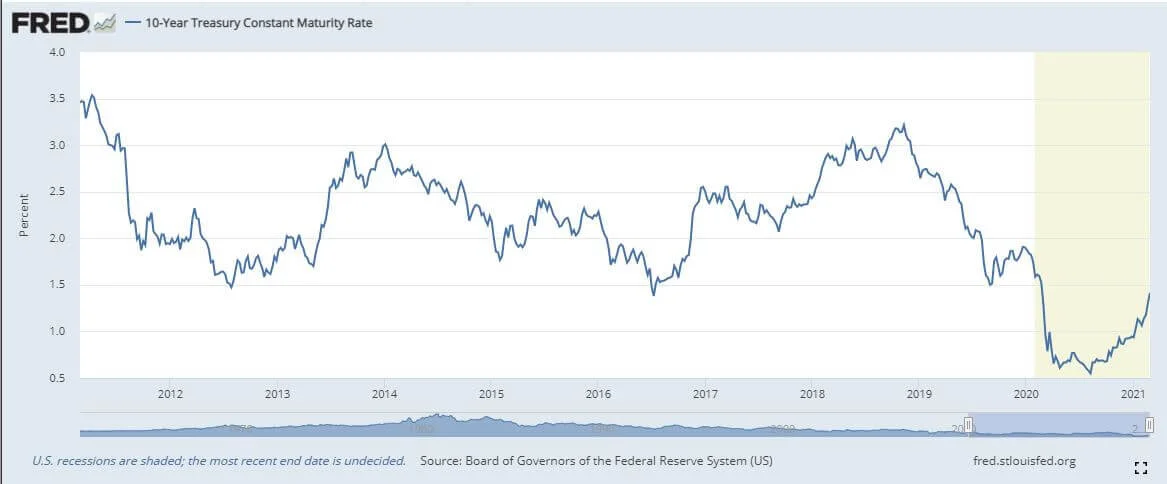

In a decreasing interest-rate environment, assuming someone's debt is not ideal. Look how interest rates have faired since 2011, per the St. Louis Fed.

This has been a massive obstacle for supplemental financing as recent debt terms were usually more favorable than legacy terms. In other words, why would you want to assume someone's 4.5% mortgage when you can place new debt on the property with a 3.6%rate loan?

Real Estate Appreciation

The other issue is appreciation.Multifamilyhas appreciated significantly over the same period. Even if aborrowerputs on an 80% LTV loan at one point, consistent market appreciation will put downward pressure on the LTV. Buying a property and assuming a loan at 55% - 65% LTV can be difficult for private investors (institutions will commonly do this regardless). The equity gap is likely too extreme in most “debt assumption” scenarios, and leveraged IRRs get too compressed.

In my experience, it took a motivated buyer to assume debt, which was usually only when the buyer had a 1031 exchange.

Future Economic Outlook

What would happen ifinterest ratesstart rising, the Fed enacts quantitative tightening, andmultifamilyvaluations begin to correct? Look at what the 10-year treasury has done over the last six months! It's nearly tripled since bottoming out in the summer of 2020.

Imagine a scenario where you can assume debt at 70% of LTV at 3.6% when the current market debt is 5.1%. Instead of raising additional equity from investors for renovations or deferred capital, you could add supplemental financing to 75% or 80% LTV. The apartment's operations must remain in good standing to meet thelender'sDSCRrequirements.

The roles could be reversed, and the legacy debt could be in high demand. Unfortunately, many owners may choose not to sell, given that they have accretive debt and wouldn't want to give it up.

Look how much the supplemental debt can juice the leveraged IRR when an owner elects to tack on a supplemental instead of assuming the ownership group's loan balance.

Assumption Financing (Supp. vs. No Supp.)

Assuming Loan With No Supplemental

Assuming Loan With Supplemental

Less equity and more accretive debt help maximize returns in the instance above. The IRR on a 10-year investment hold is up 200 bps, and the equity multiple is over 0.60 in the scenario where supplemental financing is used.

Note: The “Secondary Financing” option works well for seller financing.

Summarizing Supplemental Loans

In summary, supplemental mortgages are a secondary financing tranche that is smaller and subordinate to the first-position loan. They are a great way to increase leverage in a rising interest rate environment.

Supplemental loanshaven't been as common in the current state of real estate investment. I feel this trend will change in the upcoming years, and instead of using supplemental financing as a last resort, it will be a coveted product that many investors use.

As market participants, it’s essential to keep up with investment trends and know what tools are available when offering a project.

Related Posts

Weighing a CRE ‘Cash-In’ Refinance: A Case Study

Risks in Using SOFR Forward Curve for Rate Projections