If your bank recently contacted you to tell you that your account has been closed or your application for a checking account has been denied, this is usually a result of a negative report coming from a company called ChexSystems.

A large majority of banks in the U.S. use ChexSystems to track their customers’ banking activity. Consumers who have made banking mistakes, like bounced checks, excessive returned check charges, or too many transfers or withdrawals, might end up in their system. This means you’re basically blacklisted by most if not all banks that use ChexSystems.

Thankfully there are some great banks that don’t use ChexSystems at all! These banks offer the same services as traditional financial institutions and have high acceptance rates for new customers.

CONTENTS

- The Top No ChexSystems Banks

- What Is ChexSystems?

- What Are My Options if I’m Listed in ChexSystems?

- Why No ChexSystems Banks Are the Best Choice

- What’s the Difference Between No ChexSystems Banks and Second Chance Banks?

- The Best Second Chance Banks By State

Say Goodbye to Banking Hassles: Find a No ChexSystems Checking Account Today

Open an account today!

U.S. Bank | Earn Up To $800 Cash Bonus

U.S. Bank is the fifth largest bank in the country with the majority of its 2,000+ branches located in 26 states mostly located in the west and midwest.

You can earn up to $800 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account online and complete qualifying activities. The offer is subject to certain terms and limitations and is valid through March 12, 2024. Member FDIC.

U.S. Bank Smartly® Checking at a Glance

- A U.S. Bank Visa debit card

- Online banking and bill pay

- Mobile banking with mobile check deposit

- Send money with Zelle®

- Access to U.S. Bank Smart Rewards™ to reap additional benefits

- No NSF charges for overdraft balances under $50

- No fees at U.S. Bank ATMs

- No surcharge fees at 40,000 MoneyPass ATMs

- Member FDIC

States Where U.S. Bank is Available

If you live in one of the following 26 states where this account is available, you can apply online: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

Account Details and Costs

To get an account, you’ll need to make an opening deposit of $25. The monthly service fee is $6.95 but can be waived if you maintain a minimum balance of $1,500 or by having a combined monthly direct deposit totaling $1,000. You can also avoid the monthly fee if you are 24 and under, 65 and over, or a member of the military (must self-disclose) or qualify for one of the four Smart Rewards® tiers (Primary, Plus, Premium, or Pinnacle).

Banking Made Easy

The U.S. Bank Smartly® Checking account comes with one of the best mobile apps on the market. Over one million customers have given the app an overall rating of five stars. You can manage your entire account from a computer or your smartphone.

U.S. Bank repeatedly makes the list of one of the best banks in the country.

Open an account today!

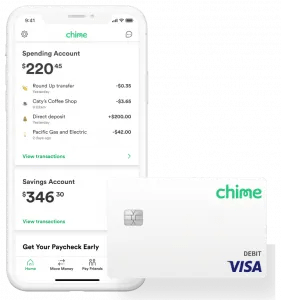

Chime | Our Top Pick

Chime® is a fast-growing internet-only financial company and our top choice for a second chance bank account.

And, best of all, Chime accepts almost all customers who apply. Even if you have bad or poor credit or have been blacklisted by ChexSystems or the credit bureaus.

Features include mobile deposits, direct deposit, online bill payment, NO monthly or annual fees, NO overdrafts fees1, NO credit check, and NO CheckSystems. Opening an account is super easy. It takes about 2 minutes and you don’t have to make an initial deposit. Here’s what we like:

No Monthly Fees

For the past couple of years, Chime’s huge growth has come at the expense of the big banks and their outrageous fees. And it’s one of the best features of a Chime account. There are no monthly or annual service charges, no minimum balance requirement, no foreign transaction fees, no fees at over 60,000 ATMs2, and no fees for mobile and online bill pay.

Deposit Cash for FREE at Over 8,500 Walgreens

Having access to a physical location for cash deposits is important to Chime members. And now it’s easy. All you have to do is go into a Walgreens store, hand the cashier the cash you want to deposit along with your Chime card, and the deposit will show up in your account immediately. This offers Chime members more walk-in locations than any other bank in the U.S. With over 78% of the country within 5 miles of a Walgreens, this is a significant benefit for millions.3

Smart Technology

Unlike big banks, Chime was created during the smartphone era and, therefore, features an app that is more than just a way for customers to review their bank accounts.

You can transfer funds to friends and family, Chime members or not… and they can claim their money instantly4 without any additional apps. The Chime app also has a series of notifications that you can turn on or turn off so you stay in complete control. Misplaced or lost your card? You can instantaneously turn off your card using the app. No wonder over 300,000 customers have given the app a 5-star review.

Customers First

Chime was one of the first to offer a “round up” option. If you use your Chime card on a purchase of $10.65, Chime gives you the option of automatically rounding up to $11.00 and putting the remaining $.35 in your free Chime savings account. And that adds up over time! Plus, Chime pays 0.50% Annual Percentage Yield (APY)5 in interest on that savings account.

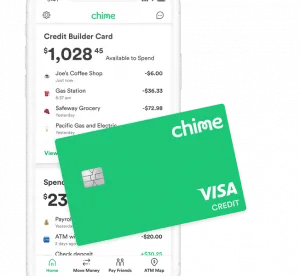

If you use direct deposit with your Chime account, you can get your paycheck up to 2 days early6. And Chime is just saying no to big bank NSF charges with a fee-free overdraft program up to $200. Finally, Chime just recently launched their Credit Builder credit card with no interest and no annual fee. We don’t think there is another company innovating for their customers like Chime.

Get a Chime Account Today!

SoFi Checking & Savings | Earn a $325 Welcome Bonus

The account is offered by SoFi Bank. It’s a checking AND savings account and we love that. Plus, they don’t use ChexSystems or your credit report to approve accounts.

SoFi Checking & Savings at a Glance

- FREE SoFi debit MasterCard

- FREE smartphone app. Manage your account online, too

- No opening deposit required

- No monthly minimum balance requirement

- No monthly maintenance fees

- No fees at 55,000+ ATMs

- Get paid up to two days early with direct deposit

How to Earn the $325 Bonus

As soon as you get your SoFi Checking & Savings account and deposit $10 or more, you’ll earn $25. When you set up direct deposit from an employer, SoFi will credit your account up to an additional $300 (depending on the amount of your direct deposit).

Using the SoFi direct deposit option unlocks additional benefits, too. First, if you overspend a bit, SoFi will cover up to $50 with no overdraft fees. Second, you’ll receive a much higher interest amount of 4.60% APY on savings account balances and .50% APY on checking account balances. If you decide not to utilize direct deposit, you’ll receive 1.20% APY on savings balances.

The sign-up process can take less than 60 seconds. With over 6 million members, SoFi is a bank you can count on!

SoFi has been great! The account was easy to open and I got my debit card a few days later. The smartphone app is easy to use and I can check everything from my computer, too. SoFi seems to be the perfect bank.

Claire M., SoFi Customer

Get a SoFi Account Now!

Chase Secure BankingSM | $100 New Account Bonus

For many people, having access to a local bank branch is paramount when setting up a checking account. With over 15,000 ATMs and 4,700 branches across the country, the Chase Secure Banking account might be the perfect fit.

Here are some of our favorite features with this account:

- NO credit check

- NO ChexSystems

- NO minimum deposit to open

- NO overdraft fees

- FREE access to over 15,000 Chase ATMs

- FREE Chase Online Bill Pay

- FREE money orders and cashier’s checks

Highly Rated Mobile App

Available for iOS and Android, the Chase Mobile app offers 24/7 access to your account. The app is highly rated, earning 4.8 stars out of 5 on the App Store and 4.4 stars out of 5 on Google Play.

You can transfer funds, deposit checks, send money with Zelle, set up account alerts and notifications, and lock your card if it’s been lost or stolen.

The app also has incredibly helpful budgeting tools, personalized insights, and the ability to check your credit score for free.

How The Account Works

Opening the Chase Secure Banking account is easy. They verify your name, address, and social security through Experian, but don’t pull a credit report or credit score. Chase doesn’t use ChexSystems for this account, either. Account approval is immediate, there’s no opening deposit requirement, and you’ll receive your Chase Secure card within a matter of days.

Chase doesn’t offer overdraft services with this account as you can only spend the money you have available and the account does not include paper checks. You should also know that using non-Chase ATMs can cost from $3.00 to $5.00 per transaction.

Chase Secure Banking carries a $4.95 monthly service fee that cannot be waived. But combined with all the free services and the $100 cash bonus when you use the card for 10 purchases within 60 days, the monthly fee doesn’t pose a problem for most customers. And, you’ll have peace of mind with Chase’s Zero Liability Protection if you detect and report unauthorized transactions.

Banking With A Leader

Chase claims to be involved with 40% of Americans in some way or another. There can be comfort in size, reach, and stability. Chase has all of that and the assurance they will be there for a long, long time.

If you’ve wanted to bank with Chase and wondered if you’d qualify, we think you’re going to be really happy with the Chase Secure Banking account.

Get a Chase Secure Banking account today!

Current | Earn High Interest

Current is another web-only national bank that has some really great features… and has become one of the fastest-growing checking accounts for consumers who want it all without all the costs and hassles.

Why are we featuring Current on our website? It’s simple: they don’t use ChexSystems or your credit report to open a new account. Sign-up takes about 2 minutes and Current has extremely high acceptance rates. But what’s really cool are the incredible features offered with this account:

- NO minimum balance

- NO deposit required to open an account

- NO overdraft fees when you overdraw by up to $100 with Overdrive™

- NO fees at over 40,000 ATMS in the U.S.

- Get your paycheck up to 2 days early with direct deposit

- Earn 4.0% interest on your balance up to $6,000

- Earn points for unlimited cashback at participating retailers

- Send money instantly for free

- An elegant but simple smartphone app

- 24/7 member support

Current offers a really unique service it calls Gas Hold Removals. What’s a gas hold? Some gas stations may apply a hold from $50 to $100 when you use a debit card to pump gas. If you only pumped $10 of gas, but the gas station places a $100 hold on your funds, you won’t have access to the $90 difference for up to 3 business days!

The Current debit card will immediately refund the hold so you have access to all your funds. We haven’t found that benefit anywhere in the marketplace.

Here’s what’s really important, though. Deposits are FDIC-insured up to the highest possible amount allowed: $250,000. We love the features, we love the smartphone app, and we love Current. That makes us think you’ll love them too.

Get a Current Account Now!

Walmart MoneyCard

Want to earn cash back on Walmart purchases – up to $75 each year? Then you might love the Walmart MoneyCard.

It’s a debit card that has some strong features such as cashback on Walmart purchases, overdraft protection, interest on your savings, and a mobile app that lets you track your purchases and deposit funds into your account.

Our favorite features include:

- Easy approval: no ChexSystems or credit check

- No initial deposit is required and there are no monthly minimums

- Deposit cash for free at any Walmart store and it shows up 10 minutes later

- Deposit checks using the Walmart MoneyCard smartphone app

- Easily request multiple cards for family use1

- Manage your account from your computer or the smartphone app

- 3% cashback on Walmart.com purchases, 2% cashback for Walmart fuel stations, and 1% cash back for use in-store2

- Earn 2.00% APY on money you set aside in a free savings account3

- With qualifying direct deposits4, you can opt-in and enjoy overdraft protection of up to $200 on eligible purchases5

- No monthly fee when you direct deposit $500+ in the previous monthly period. Otherwise, there’s a $5.94 monthly fee.6

The Walmart MoneyCard is available in all 50 states, Washington D.C., and Puerto Rico.

Get a Walmart MoneyCard Account Now!

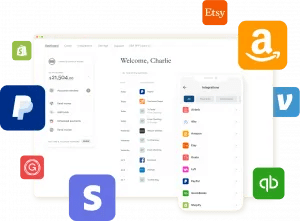

NorthOne | No ChexSystems Small Business Banking

NorthOne is a fast-growing company built specifically around business banking solutions for freelancers, entrepreneurs, and small business owners. In addition to dramatically streamlining the application process, NorthOne doesn’t check your credit and doesn’t use ChexSystems. Here’s a recap:

- FREE business Mastercard debit card

- FREE access at over 1,000,000 ATMs nationwide

- FREE online and mobile app

- FREE live chat (not a chatbot), telephone, or email support

- FREE in-app invoice creator

- NO minimum monthly balance requirement

- NO NSF fees

- NO ACH transfer fees

- NO credit check or ChexSystems

Banking Services

NorthOne doesn’t require a minimum account balance and charges a $10 monthly fee that includes unlimited transactions in your account. These include ACH payments, bill pay, debit card usage, mobile deposits, and transfers. The only other fee is $15 for wire transfers.

You can also grant read-only access to employees or your accountant or bookkeeper. This keeps your account safe while also giving access to those who need it.

Integrations

With NorthOne business banking, you can connect your account to an almost unlimited number of third-party apps. NorthOne integrates with business tools including Paypal, Stripe, Square, Etsy, Shopify, Airbnb, Amazon, Venmo, Toast, Uber, Lyft, Quickbooks, FreshBooks, Wave, Expensify, and many more. Through these integrations, you can sync transaction details, collect payments, see and pay invoices, send payroll, pay contractors, and more.

With NorthOne business banking, you can connect your account to an almost unlimited number of third-party apps. NorthOne integrates with business tools including Paypal, Stripe, Square, Etsy, Shopify, Airbnb, Amazon, Venmo, Toast, Uber, Lyft, Quickbooks, FreshBooks, Wave, Expensify, and many more. Through these integrations, you can sync transaction details, collect payments, see and pay invoices, send payroll, pay contractors, and more.

If creating and sending invoices, quotes, and estimates is critical to your business, NorthOne offers a free stand-alone invoice creator that integrates seamlessly with the banking app. We’ve tried it and think it’s an elegant solution.

Envelopes

NorthOne has created a feature that helps you plan for and manage important expense categories. They call these sub-accounts “Envelopes” and you can set up as many as you want. This allows you to set aside funds you know you’ll need in the future such as taxes or payroll. You can set custom rules for your envelopes and easily move money back and forth as needed.

Application Process

NorthOne targets account approvals within one to two business days. Information required to open an account includes name, address, and social security number or tax identification number. If applicable, NorthOne may ask for a copy of your business license and business formation documents. After you’re approved, you’ll need to make a $50 minimum opening deposit.

NorthOne is one of the most competitive business bank accounts for entrepreneurs and small business owners. Their combination of services and offerings, the fast application process, and customer support create an outsized competitive advantage for both the bank and its customers. Every small business owner understands how critical that is for success.

Open an account today!

Wells Fargo Bank

Wells Fargo recently changed the Opportunity Checking account to Clear Access Banking. And we like one change, in particular. Wells Fargo has done away with overdraft and non-sufficient funds (NSF) fees.

Clear Access Banking is a debit card-only account (no paper checks available) and if you attempt to purchase something without sufficient funds, the transaction will be denied. That’s a lot better than having the transaction approved and then discovering you’ve been hit with a $35 overdraft fee.

There is a $5 monthly fee, but that can be waived for account holders 24 years old and younger. This account is available to residents in all 50 states.

- The largest number of branches in the U.S.

- Minimum deposit of $25 to open an account

- Online bill pay and smartphone app

- Mobile check deposit

- Includes a Visa debit card

- Send and receive money through Zelle

- Additional features include account alerts, 24/7 fraud monitoring, and zero liability protection for your debit card

Get a Wells Fargo account

GO2bank

GO2bank is an offering of pre-paid card giant GoBank and we think it’s a step in the right direction. Like some of the newer “challenger banks” GO2bank will deposit your direct deposit check up to 2 days early and has cashback rewards on several categories of purchases. This account also makes you eligible for the GO2bank credit card, which has no annual fee or required credit check.

One significant drawback to many online-only bank accounts is that they have no way to accept cash deposits. But GO2bank accepts cash deposits at over 90,000 Green Dot locations nationwide. However, participating retailers may charge you a fee.

If you direct deposit over $500, your monthly maintenance fee of $5.00 is waived. And, they offer a pretty sweet overdraft protection program, but it has a gotcha charge of $15 if you don’t replace the funds within 24 hours.

Account-holders will appreciate the ability to budget their money with the help of a mobile app, budgeting tools, and a savings vault. In fact, they pay 1% on all money in the saving vault up to $5,000.

Get a GO2bank account

Navy Federal Credit Union

No matter your banking past, Navy Federal Credit Union offers traditional checking for all members across the US. With no review requirements of your banking history, NFCU is an excellent choice for active duty or retired US military, family members and government contractors. There are two banking choices to choose from: Active Duty Checking and Free eChecking.

Both account options come with a free NFCU debit card. There is no monthly service fee with direct deposit. Your account is protected from overdrafts with free savings transfers, a checking line of credit or an optional overdraft protection service. You also receive:

- Free mobile deposits

- Free bill pay

- Free traditional name-only checks

- Dividends credited monthly

Get a NFCU account

Varo Bank

Varo Bank is another internet-only bank with services based on their mobile apps for Apple and Android devices. Varo doesn’t charge fees at 55,000+ Allpoint ATMs and offers strong budgeting tools and automatic savings programs.

Opening an account is easy and Varo doesn’t check your credit or use ChexSystems. Varo doesn’t even require an initial deposit to open an account, either. There are never any monthly maintenance fees, account balance minimums, overdraft fees, foreign transaction fees, transfer fees, or debit card replacement fees.

Varo’s recent bank charter has them innovating more than ever. They have a very strong cashback program, a payroll advance option, and have started to offer their customers a secured credit card called Varo Believe.

Finally, if Varo receives a payroll notification before your payday, it can deposit your money more quickly than many banks.

Get a Varo Account Now!

Acorns

Acorns is making a name as a place to invest money for the long term, but what we really like is that they offer both checking and savings accounts. That makes Acorns another of our favorite bank accounts. As a company built to compete with the largest banks, Acorns offers some extraordinary benefits.

We love the heavy metal tungsten Visa debit card and the world-class smartphone app that allows you to manage every aspect of your new checking account such as budgeting, spending, and security.

Another nice option is the ability to round up on every purchase and Acorns will take that money and automatically put it in a savings account. This really helps build a nest egg.

It takes about 2-3 minutes to sign up and not only do you get a checking and savings account, but you also have access to an investment account once you’re ready to consider that. And, it’s free. Here’s more:

- FREEVisa® debit card

- FREE bank-to-bank transfers

- FREE physical check sending online or through the mobile app

- FREE mobile check deposits

- FREE access to 55,000+ fee-free ATMs

- NO minimum balance or overdraft fees

- NO credit check

- $3 monthly fee

- FDIC insured

Acorns was built to give everyone the tools to manage their finances which makes it one of our top picks.

Get an Acorns Account!

What Is ChexSystems?

If you have received a phone call from your bank telling you your account has been terminated, or you were recently denied a new checking account, you have probably heard of ChexSystems. But if this hasn’t happened, you’ve most likely never heard of ChexSystems.

In short, ChexSystems is a consumer reporting agency that tracks your checking and savings account activity.

The way it works is through banks providing data to the agency. This data includes the account holder’s Social Security number as well as the current account health. Customers who have bounced checks or have unpaid fees can be reported to ChexSystems, resulting in a negative listing on your banking activity report.

It is estimated that more than 85 percent of banks in the U.S. use ChexSystems and the agency has data on nearly 300 million American consumers.

Every negative listing on a banking activity report is made available to every bank and credit union that subscribes to the ChexSystems database, which can make getting a new account after being banned from your current bank extremely difficult.

Information That Appears on Your ChexSystems Report

Here is a list of six different pieces of information that can be found in your ChexSystems report:

- Any kind of fraud

- Uncollected overdraft fees, ATM transactions, or automatic payments the bank paid

- Abuse of debit card, savings account, or ATM card

- Violation of any banking rules and regulations

- Opening an account with false information

- Paid and unpaid non-sufficient funds (NSF) items

While banks that don’t use ChexSystems do not access data associated with the ChexSystems database, they will typically consult other banking activity data agencies like Early Warning Services (EWS) and TeleCheck.

Consumers who have negative listings with these companies might have their checking account applications rejected. However, most people listed in ChexSystems are usually not in EWS or TeleCheck.

What Are My Options if I’m Listed in ChexSystems?

Not having access to a checking account can make it difficult to manage your money efficiently. Studies have shown that those without a checking account waste nearly five percent of their income on fees charged by payday loan providers and check cashing companies.

Open an Account at No ChexSystems Banks

If you’ve been reported to ChexSystems, one of the best options you have is to bank elsewhere at one of the many banks that don’t use ChexSystems during the application process.

Once you’re approved, you will be able to enjoy all the benefits of having a checking account without having to worry about your negative record with ChexSystems.

Use a Prepaid Debit Card if You’re in a Pinch (Not Recommended!)

Another option people often turn to is prepaid debit cards. With a prepaid debit card, you can make electronic payments with the money you’ve loaded onto your card. Visa and MasterCard offer some of the most popular prepaid options. However, it is important to know that these cards aren’t all they’re cracked up to be.

One major disadvantage of these cards is that they have many fees associated with their use that can add up over time. The costs of loading money onto your card, along with the general hassle of having to do it every time you want to spend money, make a regular debit card that is associated with a bank account a much more attractive option.

With this in mind, opening a checking account is going to be the best way to go if you’re looking to organize your finances effectively.

Why No ChexSystems Banks Are the Best Choice

If you’ve been turned away from other financial institutions, no ChexSystems banks are great because they provide you with the exact same products and services. With most accounts recommended in this article, you can enjoy:

- No minimum balance requirement

- Low or no monthly fee

- Ability to write checks

- Online and mobile banking

- Debit card access

- FDIC-insured accounts up to $250,000

- Access to a large (and oftentimes free) ATM network

- Purchases with your bank card carry a zero liability for fraudulent transactions

With so many available benefits and federal insurance, you should never settle for any bank that offers less than the benefits listed above. No ChexSystems banks with too many restrictions along with high fees should be avoided.

While it might be tempting to go with the first bank that approves you for a new account after having lost your old one, it is important to consider all the options you have available to you and go with a no ChexSystems bank that offers you great banking services with low to zero fees.

What’s the Difference Between No ChexSystems Banks and Second Chance Banks?

This is a common and very important question. Ultimately, there are some major differences between no ChexSystems bank accounts and second chance bank accounts.

Some banks and credit unions offer second chance bank accounts to consumers who have made some banking mistakes in the past or to those who have poor credit. Oftentimes these banks will look at your ChexSystems report and determine your eligibility depending on the severity of your report. Second chance accounts usually come with rules and restrictions to help the consumer manage their money wisely.

No ChexSystems banks, on the other hand, offer traditional checking accounts to anyone who qualifies. Instead of offering a specialty account like a second chance account, these banks simply do not use ChexSystems at all during the application process.

The Best Second Chance Banks by State

Most major banks fail to offer second chance checking accounts. However, many community banks and credit unions do so under different names like “Opportunity Checking” or “Fresh Start Checking.”

Our sister website, CheckingExpert.com, regularly updates the list of banks offering second chance checking accounts in every state and puts it all in one place. Here’s an overview of these accounts and where you can find them in your area.

Conclusion

If you’re like one of the millions of Americans who have experienced issues with past banking mistakes, you are definitely not alone. Our comprehensive guides to second chance accounts and no ChexSystems banks will surely point you in the right direction and help you re-establish yourself in the banking system.

Additional Chime Disclaimers: Back to Chime Review

Chime is a financial technology company, not a bank. Banking services and debit card issued by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Credit Builder card issued by Stride Bank, N.A.

1Eligibility requirements apply. Overdraft only applies to debit card purchases and cash withdrawals. Limits start at $20 and may be increased up to $200 by Chime. See chime.com/spotme.

2Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Cash deposit or other third-party fees may apply.

3Customers are limited to three $1,000 cash deposits at Walgreens each day and $10,000 each month.

4Sometimes instant transfers can be delayed. The recipient must use a valid debit card to claim funds. See your issuing bank’s Deposit Account Agreement for full Pay Friends Transfers details.

5The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of May 22, 2023. No minimum balance required. Must have $0.01 in savings to earn interest.

6Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

Additional Walmart MoneyCard Disclaimers: Back to Walmart Review

1Family Accounts: Activated, personalized card required. Other fees apply to the additional account. Family members age 13 years and over are eligible. Limit 4 cards per account. See Deposit Account Agreement for details.

2Cash back, up to $75 per year, is credited to card balance at end of reward year and is subject to successful activation and other eligibility requirements. Redeem rewards using our website or app. You will earn cash back of three percent (3%) on qualifying purchases made at Walmart.com and in the Walmart app using your card or your card number, two percent (2%) at Walmart fuel stations, and one percent (1%) on qualifying purchases at Walmart stores in the United States (less returns and credits) posted to your Card during each reward year. Grocery delivery and pickup purchases made on Walmart.com or the Walmart app earn 1%. For the purposes of cash back rewards, a “reward year” is twelve (12) monthly periods in which you have paid your monthly fee or had it waived. See account agreement for details.

3Interest is paid annually on each enrollment anniversary based on the average daily balance of the prior 365 days, up to a maximum average daily balance of $1,000, if the account is in good standing and has a positive balance. 2.00% Annual Percentage Yield may change at any time before or after account is opened. Annual Percentage Yield is accurate as of 3/1/2022.

4Direct Deposit: Early availability of direct deposit depends on timing of payroll’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. Make sure the name and social security number on file with your employer or benefits provider matches what’s on your Walmart MoneyCard account exactly. We will not be able to deposit your payment if we are unable to match recipients.

5Opt-in required. $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid the fee. We require immediate payment of each overdraft and overdraft fee. Overdrafts paid at our discretion, and we do not guarantee that we will authorize and pay any transaction. Learn more about overdraft protection.

6No monthly fee with qualifying direct deposit, otherwise $5.94 a month. Waived when $500+ is loaded in the previous monthly period. First monthly fee occurs upon first use, the day after card activation or 90 days after card purchase, whichever is earlier.