Whether you are a beginner or a seasoned investor, the concept of investment decisions holds equal importance for both. In the blog, we’ll explore the key factors to consider when making investment decisions, the types of investment decisions that will ensure high yields, and at last, the process of helping you to make informed choices that will assure your financial growth.

- What is an Investment Decision?

- Understanding the Process of Investment Decision

- Types of Investment Decisions

- Factors Affecting Investment Decision

- Approaches to Make Investment Decisions

- Advantages of Investment Decision

- Conclusion

Master the concepts of Investment Banking with us. Check out our Youtube video on

What is an Investment Decision?

An investment decision is the strategic distribution of financial resources across various assets or projects with the goal of generating returns and achieving certain financial objectives. This vital component of financial management involves evaluating possibilities, risks, and expected returns. Investors base their selections on criteria such as risk tolerance and time horizon.

- The investment decision is based on various factors, including associated risk, return expectations, investment goals, asset types, and many more.

- Investment decisions are taken for the sole reason of generating maximum returns in the right direction and on the right asset.

- Mainly, these decisions are classified into long-term and short-term decisions, also known as capital budgeting and capital management respectively.

- Firms and even individuals possess limited monetary resources. Therefore, fund allocations should be done with the utmost care.

- Considering firms, they have top-level management authorities who work on the fund allocation, which promises maximum benefits with minimum loss.

Sign up for your Best Investment Banking Courses today and start your journey to success!

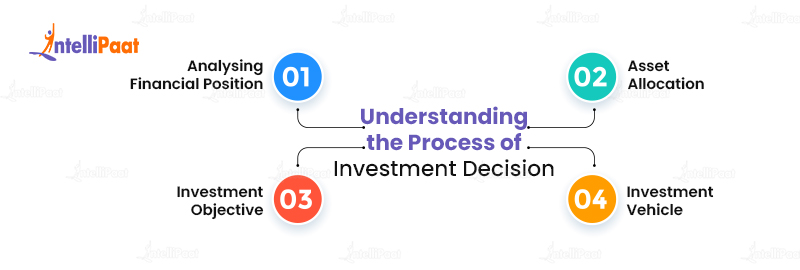

Understanding the Process of Investment Decision

Making an investment decision is itself a whole process. Below mentioned are the various steps that you need to take while deciding on your investments. You should have a lot of patience and enough understanding of the subject.

- Analysing Financial Positio

This is the preliminary stage of the investment decision-making process. Investors analyze a company’s financial status such as funding, debt, revenue, and holdings by reviewing its respective financial statements and computing specific ratios in order to comprehend and value it.The market value of a corporation determines its value. A company’s financial stats are compared with its competitors and industry standards to assess its worth.

- Investment Objective

Here, as an investor, based on many different factors, you decide whether you want to invest for the short term or the long term. As an investor, it is pertinent to set your own investment goals to expect some gain on maturity. The returns are always subjective to the amount invested, the company’s value, and the duration of the investment. - Financial Asset Allocation

The process of allocating your investments among various financial assets, such as stocks, bonds, and cash, is known as asset allocation. The asset allocation depends on how long you have to invest and how much risk you can bear. - Selection of Investment Vehicle

After the selection of asset class, investors further narrow down to a particular asset for investment. This asset is monitored till it starts generating funds and values. In a case of an unforeseen event, proper actions are taken to mitigate the risk factor.

Interested in becoming an Investment Banker? But don’t know where to start. Check out our comprehensive path on How to become an Investment Banker?

Types of Investment Decisions

Investment decisions should be taken very cautiously while considering various types of factors. It includes the financial objectives, time horizon, associated risk parameters, current market conditions, history of financial assets, and many more. It is always recommended to seek help from qualified financial experts before making any financial investment decision.

Long Term Investment Decision–

Strategic investment decision refers to a period of time that stretches far into the future. Strategic planning and allocation of financial resources in the terms of investment decisions, whether for organizations or people, are focused on long-term growth and financial stability. Organizations may prioritize market expansion, but individuals may prioritize retirement planning or real estate.

Short Term Investment Decision–

Short term investment decision, whether for businesses or individuals, prioritize immediate returns or addressing immediate financial needs. This strategy involves the allocation of financial resources for a shorter time horizon, typically one year or less. Asset allocations may be changed based on market trends, cash flow management, or capitalization on short-term investment possibilities. Individuals are able to capitalize on market volatility by holding liquid assets or engaging in short-term trading.

Factors Affecting Investment Decision

Various parameters govern an investment decision. These factors are hugely responsible for the outcome of an investment decision. Below are the various factors on which the whole process of investment decision works.

- Investment goals – This factor determines the purpose of the investment. The investor determines the goals and purpose of the investment. Also, here, the investor decides the tenure of the investment.

- Investment returns – After analyzing the market, assets with the highest probability of positive returns and those with the least associated risk are selected.

- Frequency of returns – The number of periodic returns that an investment offer is quite important. Financial management is focused on financial demands, and investors can pick assets that provide returns on their capital on a monthly, quarterly, semi-annual, or yearly basis.

- Risk – Assets with the least associated risks are selected over others. An asset is classified into three categories. The first one is high risk, the second one is medium risk, and the last one is low risk. The categorization of assets requires a risk analysis.

- Investment tenure – The maturity period and payback period decide the tenure of an investment decision. If an investment is made, then the money is blocked until it starts generating funds and value. Thus, it becomes crucial for the investors to decide on the investment period.

- Tax benefits – It is a crucial factor that affects the investment decision. Investors seek investment assets that are less taxed.

- Volatility & Liquidity – Investors want to get involved in those assets where market fluctuations do not cause catastrophic failure, even in a case of emergency

- Market inflation rate – Investors search for financial management investment options where returns exceed the country’s inflation rate. This period of the high inflation rate is also known as the golden period for investment. This rewards the investors with the opportunity to generate high value and returns from their investments.

Check our tutorial of tax planning for investors to avoid maximum taxes for yourself.

Get 100% Hike!

Master Most in Demand Skills Now !

Approaches to Make Investment Decisions

There are several approaches that investors should take careful consideration and analysis. Below we will discuss some of these approaches:

- Fundamental Analysis: Fundamental analysis involves assessing the intrinsic value of an investment by examining factors such as financial statements, industry trends, management quality, competitive advantages, and economic conditions. This approach aims to identify assets that are either undervalued or overvalued based on their fundamental characteristics.

- Value Investing: Value investing involves identifying undervalued assets in the market. Value investors look for stocks or other assets trading below their intrinsic value. They believe that over time, the market will recognize the true value of these assets, leading to capital appreciation. Value investors analyze financial statements, assess the company’s prospects, and compare the market price to the intrinsic value.

- Growth Investing: Growth investing identifies companies or sectors with high growth potential. Investors who follow this approach look for companies that are expected to experience rapid earnings growth in the future. Growth investors analyze industry trends, company growth rates, competitive advantages, and management strategies to identify potential investments.

- Technical Analysis: Technical analysis studies historical price and volume data to identify patterns, trends, and market indicators. Investors who use technical analysis believe historical price movements can help predict future price movements. They use charts, graphs, and technical indicators to make investment decisions. Don’t confuse yourself between Fundamental analysis vs Technical analysis, these are just 2 methods of analyzing the same things.

- Modern Portfolio Theory: Modern Portfolio Theory (MPT) places importance on diversification and asset allocation. According to this approach, investors should establish a varied portfolio of assets with different risk levels, aiming to maximize returns while minimizing risk. MPT employs mathematical models to determine the optimal allocation of investments in a portfolio, considering the investor’s risk tolerance and return expectations.

Invest in your future. Enroll in our Investment Banking course in Delhi and reap the rewards!

Advantages of Investment Decision

The decision to invest offers multiple benefits to the investor. It encompasses the potential for exponential gains, diversification across various asset classes, and safeguard against inflation. Also, availing of tax advantages, customizing one’s portfolio and creating substantial wealth.

It is imperative to seek the guidance of a qualified financial expert and conduct comprehensive research to make judicious investment choices.

Here are some compelling reasons why investing can be highly advantageous:

- Potential for Exponential Gains:

Diversifying investments across stocks, bonds, real estate, and mutual funds can potentially yield superior returns compared to traditional savings accounts or fixed deposits.Over the long haul, investments tend to generate better gains, albeit subject to market fluctuations.

- Diversification:

Embracing diversification is a pivotal strategy in investment decision-making.By spreading investments across different asset classes, sectors, and geographies, risks can be mitigated and the impact of poor performance on any single investment can be minimized.

This can effectively protect investments from market volatility and reduce the overall portfolio risk.

- Inflation Hedge:

Inflation erodes the purchasing power of money over time. However, investments in stocks, real estate, and commodities have the potential to outpace inflation and provide a hedge against rising prices.By allocating investments in assets that tend to keep up with or surpass inflation, long-term wealth preservation, and growth can be achieved.

- Compound Growth:

The snowball effect of compound growth occurs when investment returns are reinvested.This leads to exponential growth over time. The longer the duration of investment, the greater the compounding effect, enabling significant amplification of overall returns and expedited achievement of financial goals.

- Tax Benefits:

Certain investments, such as retirement accounts, offer tax advantages that can lower taxable income and potentially reduce tax liability.Additionally, investments in tax-advantaged accounts may allow for tax-deferred growth, whereby taxes are only payable upon withdrawal during retirement, resulting in substantial tax savings.

- Portfolio Customization:

Investing provides the opportunity to customize one’s portfolio based on individual risk tolerance, time horizon, and financial objectives.A wide range of investment options can be tailored to suit preferences, such as aggressive or conservative investments, growth or value stocks, or various types of bonds.

This flexibility empowers investors to design an investment strategy that caters to their specific needs and financial goals.

- Wealth Creation:

Investing can be a potent tool for wealth creation, enabling the growth of savings and the development of a substantial portfolio over time.Consistent investment and leveraging the power of compounding can result in the accumulation of significant wealth, facilitating the realization of long-term financial aspirations, such as homeownership, funding education for children, or ensuring a comfortable retirement.

Investing in a well-researched and diversified portfolio can yield a plethora of benefits, ranging from the potential for exponential gains and inflation hedging to tax advantages and wealth creation.

Elevate your interview game with us. Check out our well-curated Investment banking Interview Questions and Answers.

Conclusion

In the blog, we had a brief discussion on Investment Decisions. When it comes to making investment decisions, it’s essential to take into account several factors. These factors govern the whole process of investment decisions. Which includes your risk tolerance, financial goals, and market conditions.

Conducting thorough research, diversifying your portfolio, and seeking professional advice, if necessary, are critical steps in the decision-making process. By carefully analyzing various investment options and their potential returns, you can make informed decisions that align with your financial objectives. Ultimately, wise investment decisions can lay the foundation for long-term financial success and growth.

Join Intellipaat’s Community to catch up with your fellow learners and resolve your doubts.

Next

Course Schedule

| Name | Date | Details |

|---|---|---|

| Investment Banking Course | 23 Mar 2024(Sat-Sun) Weekend Batch | View Details |

| Investment Banking Course | 30 Mar 2024(Sat-Sun) Weekend Batch | View Details |

| Investment Banking Course | 06 Apr 2024(Sat-Sun) Weekend Batch | View Details |