When you think about creating generational wealth for your family, it seems like a daunting task. Most of us are just trying to make ends meet on a daily basis, so building a lasting financial legacy is just a distant dream.

The truth is, it’s not just for rich people. Anyone can build generational wealth if they do the right things. You don’t have to have a high income or inherit money from your rich uncle. But you do have to live your life in such a way that you build wealth over your lifetime.

Unfortunately, most people don’t live their financial lives with an eye on creating generational wealth. It takes long term financial discipline and a concrete plan for your money. But it's definitely a goal you can achieve with the right actions and mindset.

In this post, I’ll show you some of the best things you can do to create massive multigenerational wealth for your family.

Contents hide

1 What is Generational Wealth?

2 Why is it Important to Build Generational Wealth?

3 Building a Financial Legacy Starts with the Basics

4 How to Build Generational Wealth

5 The 6 Cornerstones for Building Generational Wealth

5.1 #1- Investing in the Stock Market

5.2 #2- Invest in Your Family

5.3 #3- Build a Family Business

5.4 #4- Real Estate Investing

5.5 #5- Create Passive Income

5.6 #6- Protect Your Assets

5.6.1 Taxes

6 How to Pass on Generational Wealth

6.1 Create an Estate Plan

6.1.1 Create a Will

6.1.2 Be Sure to Designate Beneficiaries

7 More Tips to Build Generational Wealth

7.1 Should You Leave Everything to Your Kids?

7.2 Teach Your Kids About Money

7.3 Prepare Your Heirs for an Inheritance

7.4 Should You Leave Money to Charity?

7.4.1 A One Time Gift or a Charitable Trust?

8 Generational Wealth in the Bible

9 Examples of Generational Wealth

10 The Bottom Line on Building Generational Wealth

11 My Favorite Resource for Building a Financial Legacy

What is Generational Wealth?

By definition, generational wealth is wealth (cash, stocks, real estate, etc.) that is passed down through a family for generations. It creates a distinct financial advantage to those that inherit it. However, it tends to dwindle from generation to generation as family members deplete the wealth without replacing or increasing it.

Statistics show that after the second generation, 70% of wealth is depleted, and after the third generation, that increases to 90%. So the lesson here is that not only should you pass down assets, you should also pass down the knowledge and habits that preserve those assets from generation to generation.

Why is it Important to Build Generational Wealth?

Passing down wealth through the generations is a great way to bless family members you may never even meet. This financial legacy gives your family the ability to have more freedom of choice in their lives, assuming they act responsibly. Some of the advantages generational wealth creates are:

- The ability to choose a career you love, regardless of how much it pays.

- Being able to live a life of service to others without worrying about earning a paycheck.

- The ability to afford a college education with no debt.

- Being able to give to charity on a much higher level.

- The ability to make better life decisions when money is less of a factor.

Building a Financial Legacy Starts with the Basics

When it comes down to it, making generational wealth starts on the personal level with the basics of personal finance:

- Having complete control over your finances

- Budgeting– using your money as efficiently as possible

- Staying out of debt– consumer debt does not build wealth

- Spending wisely

- Investing wisely

Here's one of my favorite videos about leaving a legacy from Dave Ramsey that explains the concept extremely well…

How to Build Generational Wealth

So, how do you create generational wealth? You focus on building wealth while keeping an eye on the future for how it will be used. Not just for the next 20 or so years, but for the next 100-200 years.

This extremely long-term view for managing money is a perspective most of us don’t tend to think about. But when you get into the mode of extremely long-term thinking about wealth, you can build a financial legacy that lasts an incredibly long time!

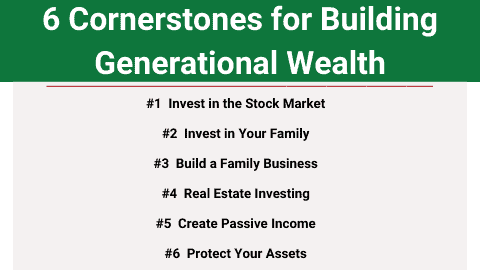

Below, you’ll find 6 cornerstones to building generational wealth that lend themselves well to a long-term wealth financial perspective.

The 6 Cornerstones for Building Generational Wealth

#1- Investing in the Stock Market

Stock market investing is an incredibly good way to build wealth over your lifetime. Especially when you start investing at a young age, the exponential nature of the stock market will easily make you a millionaire!

You don’t have to have a finance degree to invest in the stock market. Although you do need to understand some basic concepts about investing, it’s really not that hard when you just stick to the basics.

Of course, you will need to be diligent at putting money into investments over a long period of time. But as time goes on and your balance grows, you’ll build an incredible financial legacy for your family!

#2- Invest in Your Family

One of the best ways to ensure your financial legacy is preserved is to invest in your family. There are several ways you can do this:

- Invest in education- educating your kids (and/or their kids) without taking out student loans allows them to start life on a better financial foundation than most of their peers.

- Teach your kids about money- not only should your kids know how to be good financial stewards, they also need to know how to continue to build a financial legacy for their kids as well.

- Invest in yourself- the more you build your knowledge and skills, the more money you can earn to create wealth that lasts for generations.

- Invest in your marriage- Divorce is a destroyer of wealth. Investing in your marriage pays dividends far beyond anything money can buy.

#3- Build a Family Business

Another good way to create lasting wealth is to build a family business. Your children can work in the business from a young age. Teaching them how a business runs and how to work hard is a legacy in itself.

As time goes on, you can transition the business to your children if they are interested. If they are not interested in running the business for themselves, you can sell it to someone else and leave the proceeds to your heirs.

Although the majority of family business aren’t passed down to the next generation, it can still be a good way to create lasting wealth for your family to enjoy.

#4- Real Estate Investing

Real estate investing is easily one of the most lucrative generational wealth builders available. If you look at the investments of most any wealthy family, it almost always includes real estate in one form or another.

The great thing about investing in real estate is that it creates cash flow now, while the properties increase in value over time. Later, you can leave the properties to your heirs who will benefit from cash flow and appreciation as well.

If you desire, you can reinvest the cash flow from your properties into more properties, using the snowball effect to build a real estate empire that creates millions of dollars of wealth that can be passed down through generations.

See all my posts on Real Estate Investing

#5- Create Passive Income

Passive income is a lucrative way to produce ongoing income for your heirs long after you’re gone. There are several ways you can produce passive income that can be handed down over many generations:

- Creative works such as books, art, and music

- Patents

- Income producing real estate

- Dividend paying stocks, mutual funds, and ETF’s

#6- Protect Your Assets

If you plan on handing assets down to your heirs, and eventually their heirs, you need to protect those assets. Unfortunately, many people don’t do this, and they end up losing much of their hard-earned wealth as it is passed down.

Taxes

It’s extremely important to know how your assets are taxed. If you don’t pay attention to taxes, a large portion of your money ends up in government hands, which is truly a tragedy. Some of the taxes you need to watch out for:

- Gift taxes- If you gift some assets to your heirs before your death, you may be taxed depending on the value of the assets. However, there are ways to avoid gift taxes.

- Estate taxes- depending on how much your estate is worth, your assets may be taxed at the federal and state levels. Not all states have estate taxes.

- Inheritance taxes- a tax on the privilege of certain heirs or beneficiaries to inherit the property of a deceased person. This is a state tax only, and not all states have an inheritance tax.

How to Pass on Generational Wealth

As you build up assets over time, you should create a plan for passing them on to the next generation. Below, you’ll find some of the top things you should do to successfully execute the transition with as little fuss as possible.

Create an Estate Plan

Estate planning is the process of determining how your assets will be preserve, managed, and distributed upon your death. It can also function as a plan in case you become incapacitated.

Estate planning includes:

- Naming an executor to carry out the plan

- Naming beneficiaries

- Creating funeral arrangements

- Making one-time charitable donations

- Setting up trusts for ongoing charitable donations

- Setting up trusts to benefit family members

- Making a will

- Determining who will take custody of minor children, if needed

- Determining who will take custody of pets

- Strategies to limit taxes on your estate

You will likely need the help of an attorney to create an estate plan. The more assets you have, the more complicated your estate plan can get.

An experienced professional will guide you through the process, asking you the right questions to make sure you create a well thought out estate plan that eases the transfer of assets, and minimizes headaches.

Create a Will

Creating a will is an absolutely necessary part of creating an estate plan, even if you don’t have a lot of assets. It’s a legal record of your exact wishes for how your money and property should be distributed upon your passing.

If you don’t have a will, you never know how your heirs may act, especially if there are substantial assets on the line. Without a will, it can get really ugly, really fast.

The clearer your directions for how the assets should be distributed, the better. You should leave no questions as to how assets should be distributed, and why you chose to do it that way.

Be Sure to Designate Beneficiaries

One easy way to make sure your assets pass efficiently to the next generation is to designate them as beneficiaries on all your accounts. Upon your passing, your beneficiaries can get the assets with little to no hassle. This will easily save your family a lot of problems during a tough emotional time, as they won’t have to go to court and let a judge determine how assets should be distributed.

You should make sure you designate beneficiaries on all your investment accounts (IRA, 401k, 403b, etc.), life insurance policies, and bank accounts.

More Tips to Build Generational Wealth

Should You Leave Everything to Your Kids?

Is leaving all your assets to your kids a wise thing to do? Well, it depends on your kids.

If your kids have proven themselves to be responsible with money, then yes, it’s probably a good idea.

But what if your child is totally irresponsible? Or worse yet, what if they are wasting their life on drugs or some other addiction? Should you leave them an inheritance? Absolutely not.

Generational wealth is meant to be a blessing. It’s a tool they can use to make their life, and the lives of others, better. It’s an asset they can also increase through investment and leave generational wealth to their children as well.

Leaving an inheritance to irresponsible individuals is a recipe for disaster. When you do, you become an enabler of their questionable behavior, acting as a contributor to their problems instead of a solution. Always leave your assets to someone whom you know will be a good steward.

Teach Your Kids About Money

One of the smartest things you can do to prepare your family for generational wealth is to teach your kids about money. The more they know about personal finance and how to be a good financial steward, the more likely they are to be good stewards of an inheritance.

Prepare Your Heirs for an Inheritance

Statistics show that 70% of generational wealth is depleted after the second generation, and 90% after the third generation. Let your heirs know about your estate plan and how you want them to handle their inheritance. An unexpected inheritance usually doesn’t last very long.

Should You Leave Money to Charity?

As part of your estate plan, you may want to leave some, or all, of your assets to charity. Of course, giving to charity is always a good thing to do!

If you have responsible heirs you want to bless, leave most of the money to them, and allocate a portion to charitable causes.

However, if you have irresponsible heirs and you don’t want to enable their questionable behavior by leaving them a pile of money, then you should consider leaving your entire estate to charity.

A One Time Gift or a Charitable Trust?

In your estate plan, you can set it up as a one-time gift upon your death. Another option is to set up an ongoing charitable trust that doles out a small portion of the assets periodically. The money in the trust can be invested, and your charitable contributions can go on pretty much forever if you set it up properly. Imagine being able to bless various charities for decades, or even hundreds of years after you pass away!

Generational Wealth in the Bible

“A good man leaves an inheritance to his children’s children…”- Proverbs 13:22

Throughout the Bible, multigenerational wealth is talked about as a blessing. From Abraham, Isaac, and Jacob to Job and many others, wealth handed down through generations is seen as a positive thing that strengthens families and increases influence when done right.

As Christians, we are called to have a positive influence in the world, and using our wealth is one way we can do that. When you leave an inheritance, you have the ability to ensure that your wealth outlives you and impacts the world for generations to come.

For instance, when King David died, he left his wealth to Solomon, who was finally able to build the temple in Jerusalem. Not only that, Solomon was able to multiply the wealth he received and use it for other great things such as creating prosperity and protection for Israel.

Examples of Generational Wealth

Of course, there are some famous examples of generational wealth we all know about, such as the Kennedys, the Rockefellers, and the Waltons, among others.

But you don’t have to be incredibly wealthy to leave a financial legacy for your family. Even if you come from modest means, you can leave a legacy to your family that long outlasts your lifetime.

In the book “Everyday Millionaires: How Ordinary People Built Extraordinary Wealth―and How You Can Too”, author Chris Hogan tells story after story about people who make an average living, yet amassed enough wealth to become financially free enough to leave money to their kids and favorite charities.

It’s about being a good steward of what God has provided to you, which includes a solid plan for passing it on.

The Bottom Line on Building Generational Wealth

Leaving a financial legacy of generational wealth takes a lot of preparation and planning. It starts with managing your finances well. Once you have that down, you can start saving a lot of money, investing, and building wealth.

As time goes on and you build your wealth, you can start creating a solid plan for transitioning that wealth to others after you’re gone.

There are no right or wrong answers as to who you should leave your money and property to when you die. But, you definitely need to be comfortable with your plan.

In the end, you should also remember that leaving a legacy is not all about money and property. Teaching your kids to live a morally upstanding life, love their neighbor, and be a good steward of what they have is the most important legacy you can leave.

My Favorite Resource for Building a Financial Legacy

One of my favorite resources on creating generational wealth is an awesome book by Dave Ramsey- “The Legacy Journey: A Radical View of Biblical Wealth and Generosity”.