- HubPages»

- Personal Finance

Updated on July 13, 2013

Contact Author

A Budget - Every Family Needs One

A Household Budget Begins with Commitment

A household budget isn't just a good idea, it's an essential idea. It can save money. I often compare a budget to the rails on a boat. Most of the time you aren't aware that the rails are there, but when you suddenly encounter turbulence, you're glad that you have something to grab onto. A family budget keeps you from being swept overboard. Budgeting is a skill that we all need to develop.

It's possible to navigate your financial affairs without a budget, but then you surrender your financial situation to luck, and luck comes in two forms: good and bad. A home budget takes the luck out of your finances and replaces it with a plan. A household budget is very much like a small business plan. This article reviews the basic concepts of budgeting and offers some recommendations that will save you money.

It Takes Commitment

Some basic thoughts before you decide to create a household budget.

Anything important in life begins with your head, your attitude. If you think that a home budget may be a nifty idea and maybe you'll give it a shot, please stop. A budget requires more than putting numbers down on paper. In this article I assume that there are two people involved in the process, you and your spouse or partner. The concepts apply to an individual as well.

Here are the basics of your mental attitude toward home budgeting.

· Make a commitment, a solemn promise to you and your family. A commitment, like a goal should be very specific. "Yup, we're really going to give it a try this time" doesn't cut it. Believe me, I've tried it both ways. To make a home budget work you have to commit yourself to it. Does this mean that you can't go over budget on a specific line? Of course not. What if there is a sudden spike in the price of home heating oil? Your oil delivery service won't be impressed if you send them a letter saying that the invoice will put you over budget, so you're going to skip this one. You're in for a chilly winter. Commitments aren't fun, but it's required for smart budgeting. We human beings are hard wired to take life as it comes at us, and making a commitment can be uncomfortable. It's uncomfortable but necessary. I once heard a joke that the easiest way to get rid of co*ckroaches is to ask them for a commitment.

· How does a household budget commitment work? This is the easy part. I'm not going to suggest that you have a long list of promises - they're handled in the budget lines because every line is a promise. What you need to commit yourself to, at bare minimum, is to review your home budget as least monthly.

· What if you go over budget? Does this mean that you've failed? As I discussed above in the example of a spike in home heating oil prices, sometimes things are beyond your control. However, if you go over budget on discretionary items, it's time to review your commitment.

· A budget is written on paper or a computer file, not carved in stone. Any budget, especially if it's your first, has to have some flexibility planned into it.

Your Household Budget - The Nuts and Bolts

Once you allow your attitude to turn itself loose on your finances, then it's time to look at the mechanics of how to write a budget. These ideas are not the only ones; I set them forth hear as a result of my decades as CEO of a small business. I have also written a book on small business planning, which includes budgeting, entitled The APT Principle: The Business Plan that You Carry in Your Head. These ideas work.

1. Use software tools. I have used Quicken and Quickbooks by Intuit for many years. They are the recognized programs for managing your personal finances (Quicken) and for a small business (Quickbooks). One of the amazing stories of the technological era is that Microsoft was never able to topple Quicken from its lofty perch with its program Microsoft Money. So many people use these programs that help is often as easy as calling a friend. This is a good thing, because Intuit's tech support leaves a lot to be desired. I discuss Quicken here, because it is used for personal finances. The Quicken budget tool is excellent. You go row by row, month by month and enter your budget figures. If it's the same for all 12 months, it just repeats across the row. I won't go into all of the wonders of the Quicken program, only it's budgeting capabilities. Once you have entered all of your budget lines, Quicken will warn you if you write out a check and it brings you over budget on that line (or category). Nothing like having a nasty little nanny in your computer to keep you on the straight and narrow. If you're unfamiliar with Quicken, please see the video to the right.

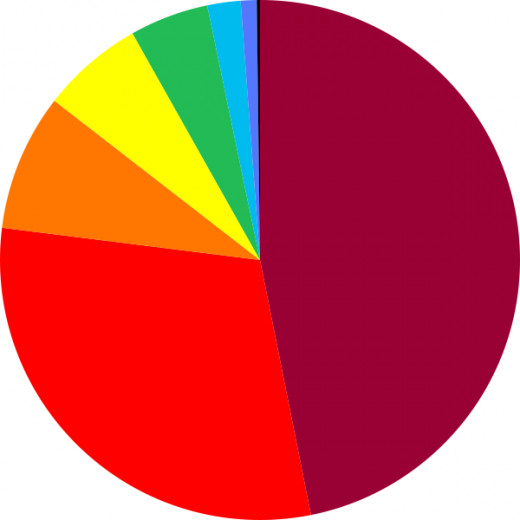

2. Microsoft Excel. You can use Excel, Microsoft's spread sheet program in conjunction with Quicken to massage the data and perform "what if" scenarios. What if scenarios are one of the greatest tools created by the advent of spreadsheet programs. What if you shave off $150 from this budget line? How does it affect the bottom line? It's a budget maker's dream. Also, it's graphing ability is better than Quicken, with virtually any type of graph imaginable at your fingertips. If you Don't have Quicken, you can write your budget directly into excel. The software comes with budgeting modules. Excel isn't the only spreadsheet program on the market, but as with so many other types of software, mighty Microsoft has given computer users worldwide a recognizable standard to work with. The nearby video to the right shows a simple explanation of making a budget using Excel.

Do you work from a written household budget?

3. Where to start? You should begin with last year's budget, or, if you didn't have a budget last year, start with a simple spending report, one that lists, line by line, how much you spent for each category of spending. Now you're ready to begin the work. Oh yes, it is work.

4. Budgeting takes work. It's not complicated, it's just work. Caution: budgeting can present a lot of opportunity for arguments. Both partners should begin with a commitment to each other that you will probably disagree on some items. Flag these items that you can't come to a ready agreement on and put them down for discussion (and resolution) later.

5. Discuss each household budget line and look realistically to the future. I gave an example above about a home heating oil spike wrecking a budget. If you have a budget line for "major equipment purchases" (and you should) here is where you may realize that your refrigerator is on its last legs, and you should put in a replacement number in that line. Create multiple sub lines or sub categories here for other appliances in the house. You whole household category and all of its sub categories is an important part of your budget. Will you house need a paint job? What are other repairs that can't be put off. Maintenance is necessary, and if neglected too long, becomes an expensive capital improvement project.

6. The most important line in your budget. I ca;ll it GOK for God Only Knows, and I'm not taking his name in vein because it includes within it a prayer. This is the budget line for unanticipated expenses. Things happen; such is the way of life. A year after we finished renovating our big old house, I strolled into the living room one day, only to discover that it was raining. Raining in the living room? An old pipe had become corrupted and let go, taking part of our living room ceiling with it. $3,000 in unanticipated expenses.

7. Budget cuts. Here is where family budgeting can get testy, and why it should begin with a loving commitment to each other, not just to numbers on a page. Amazement can begin to set in when you see that you are spending money on things that you could easily do without. I'm talking about discretionary spending here. Do you really have to eat out every night? How about a couple of glasses of wine and sardines on toast? Good for your waistline too. How many articles of clothing that you take to the drycleaner can just be washed and dried at home. If taken out of the dryer right away they should be wrinkle free. What about non discretionary items, such as heating oil. Would it make sense to wear a sweater and crank down the temperature a notch?

Creating a household budget, and committing yourself to it, can solve your financial problems. The key is to begin, and to stick with it.

Copyright © 2012 by Russell F. Moran All Rights Reserved

Related

Financial Planning

Mastering Financial Stability: Your Ultimate Guide to Bi-Weekly Budgeting

by Idris0

Understanding Finance

Free Household Budget and Expenses Spreadsheets and Templates

by e13o135

Making Ends Meet for Families

Best Family Budgeting Ideas

by Audrey Kirchner6

Personal Finance

Personal Household Budgeting Tools, Home Budget Smartphone Apps, And Family Budget Aids Everyone Should Use

by Joseph Davis1

Family Budget

Household Budget Tips: How to Save Money on a Tight Monthly Budget

by Joseph Davis6

Popular

Making Ends Meet for Families

3 Secrets to Transforming Your Family's Future

by Abir Bandyopadhyay0

Family Budget

Remove Family Account on Cash App

by Harry Sheen0

Family Budgets

10 Great Things You Can Buy for $10 Million: You Know You Want Them

by Aurelio Locsin13