- HubPages»

- Personal Finance»

Updated on May 7, 2013

Contact Author

So you've decided to make that next big purchase. Maybe it's that car you've wanted or that dream house. Since most of us don't have tens or hundreds of thousands of dollars on hand to spend, we have to get financing.

When you apply for a loan, lenders are looking for three things. First they want to make sure you have the income to afford the new debt as well as any other debt you may have. Second, they want to know the collateral is worth enough to in the market should you default on the loan (some loans like credit cards and personal loans have no collateral). And third, the lender needs to know that you have paid your previous debts in a timely fashion.

That is where credit reports come in.

When I was in elementary school, teachers were always warning that bad behavior and bad grades would go on your “ permanent record” that will follow you “wherever you go”. It's seems humorous now that a fifth grade spelling test would have anything to do with my future. But a Credit Report is as close to that “ permanent record” as most people ever get.

Simply put, a credit report (also known as a credit file or credit history) is a computerized review of your consumer debts and payment histories for the last 10 or so years. By looking at the report, a loan officer or underwriter is able to tell if the applicant is a good credit risk or not. The report will tell how many times the person has been 30, 60 or 90 days late on a debt and will provide a record of any charge offs, repossessions, foreclosures, bankruptcies, judgments, tax liens and more.

Consumer credit reports are compiled and issued mostly by three major credit reporting agencies. (Experian, Trans Union and Equifax). Most lenders report consumer credit information to all three of these agencies. They usually access an applicant's credit report through a credit bureau. A credit bureau is a company that collects and maintains credit information from the reporting agencies and sells them to lenders and consumers.

Lenders heavily rely on credit reports to make lending decisions. So it is crucially important that you pay all your bills on time. It is also important that you monitor your credit history to see what is being reported in your name. The Federal FACT ACT of 2003, allows you to get one free credit report a year from each of the three credit reporting agencies. Experts recommend that people regularly examine their credit reports to weed out and repair mistakes in their record, or worse, if someone has been using your credit illegally. It is important to monitor your credit so there are no surprises that pop up and cause you to be denied when you apply for that car loan or mortgage loan. Corrections can usually be made by contacting the credit bureaus for help. Google “credit reports” or any of the credit reporting agencies for information on how to obtain your free credit report. Since the same mistake can be on two or all the agencies reports, it would be necessary to fix the problems on the each of them. To avoid missing any credit, most mortgage lenders purchase merged reports from their local credit bureau. Merged reports have all three reporting agencies information in one report.

Credit Scores

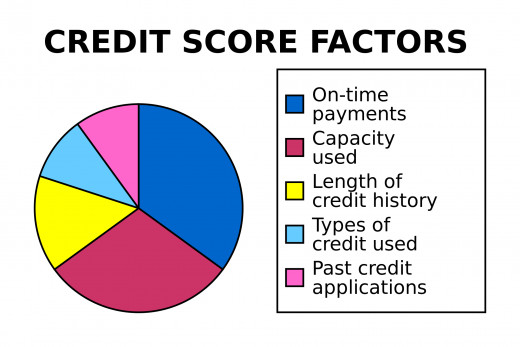

Credit scores were developed to allow lenders to make faster credit decisions. In short, a credit score is a numerical summery of your credit history. The score is generated when the lender or consumer purchases the credit report. The score is compiled through a series of statistical models. The formulas are confidential but the basically the following factors are instrumental in the compilation of credit scores:

Total Debt

Payment history

Number and severity of delinquent accounts

Recent inquries

Type, number and age of accounts

By far FICO is the most popular score and is used by most lenders. FICO scores have a range of 350-850. (Higher scores are better) The FICO company has slightly different scores for Bank Cards, Auto loans and Mortgage Loans.

Credit scores are used to make more rapid credit decisions. For example, manual mortgage underwriting used to take some time to reach decisions, now with credit scores and automated underwriting systems, a preliminary determination can be made in a few minutes. Car loans can be approved quickly now with a minimum of work. Credit card companies buy information from the bureaus to make pre approval offers to large numbers of people based solely on their credit score.

Fixing Bad Credit

What if your credit is bad? You may have previously not paid very much attention to your debts or there was a interruption in your income that caused you to miss payments. That does not mean all is lost, but it may take time, patience, sacrifice and hard work to get that score back up again. The best way to do is to make your regular payments on time and pay down debt.There are companies that offer to help you (for a price). But be careful when picking. According to the Federal Trade Commission, many of these companies are scammers and besides everything they can do for you, you can do yourself for much less than they charge. But credit scores are not perfect. They have been criticized as being to easy to manipulate. I won't get into what those tricks are in this Hub, but anyone with an internet connection can get access to them.

So, bad credit can be repaired. Granted much bad credit is from personal financial crisises. But it is best if you can keep your credit ratings and score high. It takes discipline and regular reviews of your credit reports. It also helps if you live within your means and only use credit when it is necessary.