Knowing when you can retire means putting together the pieces of retirement savings, social security benefits and other critical retirement topics

One of the most common and frustrating questions I hear readers ask is, “When can I retire?”

Most people aren’t exactly in love with their jobs and dreams of sipping Pina Coladas under a palm tree somewhere are among America’s favorite hobby’s.

Getting a good answer on when you can retire is frustrating because there are so many moving parts. It’s not one question but many about social security benefits, retirement investing, paying for healthcare in retirement and just making sure you have a stable retirement paycheck.

It’s why financial planners and other retirement experts charge big bucks to help figure it.

But you can answer your own retirement questions if you tackle the most important topics, the five critical topics in retirement planning.

This guide is the sum of years in financial planning and investment management as well as more than a few hours spent trying to answer my own retirement questions. I’ve packed it with as many worksheets and checklists as I could to make retirement planning as straight forward as possible.

It’s a long retirement guide at 15+ pages so you might want to bookmark or link to the resource. I’ve tried to lay it out with all the detail you need to get started planning for retirement and the resources you need to answer all your questions. I’ll be updating the guide regularly so feel free to recommend additions and changes in the comments.

It’s a long retirement guide at 15+ pages so you might want to bookmark or link to the resource. I’ve tried to lay it out with all the detail you need to get started planning for retirement and the resources you need to answer all your questions. I’ll be updating the guide regularly so feel free to recommend additions and changes in the comments.

Jump to one of the 5 Critical Retirement Topics:

Getting the Most out of Social Security Benefits

How to Pay for Health and Long-Term Care Insurance

Critical Changes in Your Investments as You Age

How to Create a Retirement Paycheck

What You Can’t Avoid in Estate Planning

Getting the Most Out of Social Security Benefits

You pay into Social Security benefits your entire working life. Self-employed individuals pay double to cover the employer’s share.

Shouldn’t you get the most out of your promised retirement benefits?

Overlooking the argument that Social Security might have to reduce benefits in the future or that the full retirement age may have to be increased, wouldn’t you like to get everything you’re due for your years of payments?

There are a lot of misconceptions out there about Social Security and a lot of mistakes that can cost you thousands a year in benefits. In fact, most people don’t know the difference in when they retire could double their monthly benefits.

This article will walk you through the most important points of Social Security benefits, how to plan for retirement and how to get the most out of the program. Scroll down to the bottom of the section for an age-based financial planning checklist you can print out.

What You Don’t Know about Social Security Benefits Can Hurt You

Most Americans are, or will become, beneficiaries of Social Security. According to the U.S. Census, SSI benefits are the single largest income source for people 65 or older.

In fact, one-in-five retired married couples and two-in-five unmarried retirees depend on Social Security benefits for more than 90% of their income.

Despite the fact that most financial experts advise people to wait until full retirement age to start collecting benefits, nearly 70% of Americans claim SSI early. That cuts into their monthly checks and makes it more difficult to make ends meet.

Before we get into the facts you need to know about Social Security, check your SSI IQ with the following questions.

The Social Security Administration (SSA) was created in 1935 to provide a monthly income to seniors. During the Great Depression, many people were forced into horrible poverty because they could no longer work but had no savings to pay for living expenses.

The Social Security Insurance (SSI) program pays a monthly benefit to those over a certain age, the disabled or widows of eligible participants. To be eligible, you have to pay taxes on earnings for at least 40 quarters (three months) over your lifetime.

That’s the basics of Social Security but there are a lot of details that can mean a big difference in how much you get each month in retirement.

The SSA sets ages at which you can collect benefits depending on when you were born. Anyone can start collecting monthly benefits at the age of 62 but your check will be reduced unless you wait to collect at your full retirement age (FRA).

That FRA is 65 years old for people born in 1937 or earlier and creeps higher for everyone else. If you were born between 1943 and 1954, you can retire with full benefits at 66 years of age. If you were born after 1959, you’ll have to wait until age 67 to start collecting full benefits.

Your monthly social security benefit is a fixed amount determined by when you start collecting benefits. If you start early at 62, you will collect just 70% of the full benefit (for those born after 1960) or about $952 a month on the current average $1,360 monthly benefit.

The amount you collect will increase by a cost of living inflation adjustment each year but that’s it. Your monthly benefit doesn’t ‘reset’ to the full benefit amount once you reach full retirement age if you started collecting early.

A delayed retirement credit is a percentage increase in Social Security benefits for every year you wait to retire after your full retirement age and up to 70 years old. The current increase is around 8% which means you get an additional 8% of monthly benefits for life for every year you wait.

That means for people born after 1959 with an FRA of 67 years old, you could potentially collect 124% of your full social security benefit if you wait to retire at 70 years old. That could make your benefit around $1,686 a month!

Another common misconception about SSI benefits is that your benefits are cut if you make over a certain amount. This is only true if you retire before your full retirement age. If you wait to retire then you can make as much as you want and still get full benefits.

What You Absolutely Need to Know about Social Security Retirement

- To be considered “fully insured” and be eligible for retirement and survivor benefits, you need to pay Social Security taxes for at least 40 quarters, about 10 years, of employment. To receive credit for a quarter, you need to make at least a certain amount over the three months ($1,260 in 2016).

- There is no earnings limit to SSI benefits if you retire at full retirement age or later. If you start taking benefits before this, your monthly check will be reduced by $1 for every $2 you make over a certain limit.

- You’ll need the following documents when you contact the Social Security Administration before you retire: social security card, birth certificate, proof of citizenship (if born in the U.S.), spouse’s birth certificate and SS number, marriage certificate, military discharge papers (if applicable) and most recent tax returns or W-2 forms.

Getting Ready to Collect Social Security Benefits

There are a few things you can do to get the most out of your Social Security benefits. Estimating your benefits is easy with the annual statement provided by the SSA. You’ll also be able to estimate how much more or less you can collect depending on the age you choose to start collecting benefits.

The amount you will collect from Social Security should tie into your broader retirement planning. Knowing how much you will collect from SSI will give you an idea of how much income you need to make up with investments.

Use the steps below and the worksheet to estimate your retirement income needs and the gap between SSI benefits and total expenses.

- Review your annual Social Security Earnings and Benefit Estimate Statement while you are working. You can call the Social Security Administration at 1-800-772-1213 to report any mistakes.

- Determine how Social Security benefits fit into your total retirement income. Will it be a large percentage of the total or will you have other funds.

- Estimate your retirement spending needs and how much you can expect from SSI benefits. Start filling the gap in estimated income by increasing contributions to retirement plans like a 401k or IRA.

Social Security Benefits Resources

The Social Security Administration is actually easy to reach compared to some other government agencies. I’ve only had to wait five to ten minutes during the few times I’ve had to call. It is still easier to use some of the websites available to find what you need.

- Social Security Administration 1-800-772-1213 or socialsecurity.gov

- Social Security Earnings and Benefit Estimate Statement, ssa.gov/mystatement

- Social Security Administration Frequently Asked Questions, ssa.gov/planners/faqs.htm

- Retirement Benefit Calculator, ssa.gov/planners/calculators.htm

I’ve developed some simple financial calculators to help you pay off debt, save more money and meet your investing goals.

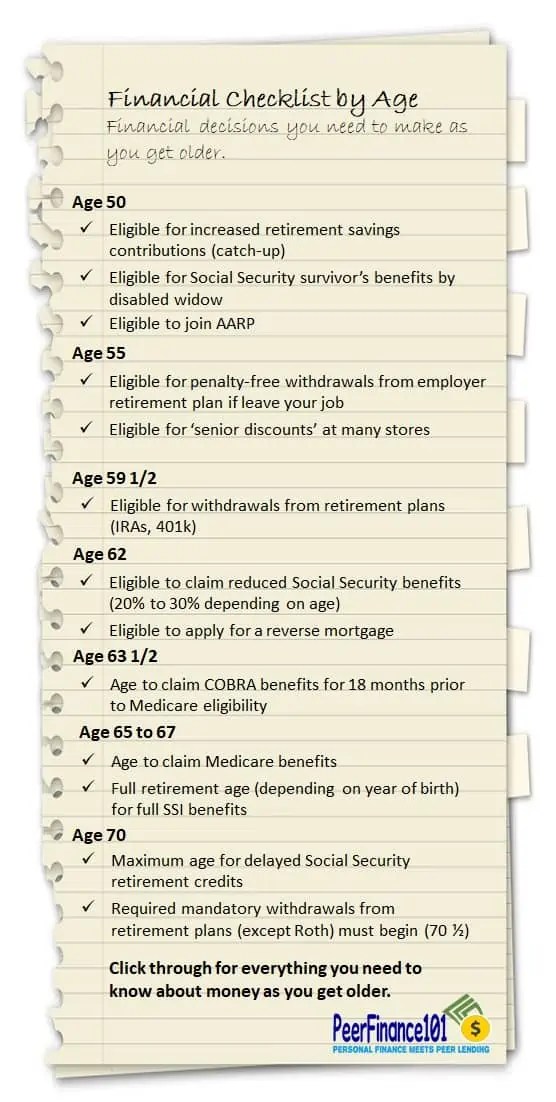

Retirement Checklist by Age

I’ve put together a financial checklist by age for some of the most common questions I get about finances and getting older.

Most of your pre-retirement financial planning will begin at age 50 when you are eligible to increase contributions to retirement plans along with some other benefits.

Don’t take this checklist as meaning retirement planning doesn’t start until 50 years old. Your retirement savings contributions should start as early as possible to give you the benefit of compound interest and decades of investing.

Social security benefits are much more important than many people understand. The monthly check you get could account for the majority of your income in retirement. That means you need to know everything you can to increase your SSI benefit and use it in your retirement planning.

How to Pay for Health and Long-Term Care Insurance

Healthcare in America has been a contentious issue over the last several years but what isn’t up for argument is the fact that you must have healthcare insurance as you get older.

Medical expenses increase significantly as you get older. The Bureau of Labor Statistics reports that Americans 65 and older spend nearly $6,000 a year on healthcare with more than half ($3,882) going to health insurance. Medical expenses for older Americans are almost double the amount spent by those 25 to 44 years of age, with annual costs of $3,322, and nearly six times the amount spent by those under 25 years of age.

The rising cost of insurance leads some people to cut back on benefits to save on premiums but it’s a bet you don’t want to make. Half of all personal bankruptcies are associated with unpaid medical bills.

What You Need to Know about Heath and Long-Term Care Insurance

Keeping affordable health insurance is one of most often cited reasons people work beyond their retirement age. Health insurance can be prohibitively expensive for those not covered by an employer plan.

Are you ready to pay for health insurance in retirement? Do you know your options and the different types of coverage you need?

Let’s test your retirement healthcare knowledge before looking into the details of health insurance and long-term care.

Medicare covers people age 65 and over as well as those under 65 with specific disabilities and anyone with permanent kidney failure. Medicare doesn’t cover everything though and many beneficiaries purchase supplemental (Medigap) policies to pay expenses not covered.

Medicare coverage consists of distinct components:

- Medicare Part A covers inpatient hospital services. It is premium-free for most beneficiaries because it is paid for by payroll taxes from currently employed workers.

- Medicare Part B is needed for outpatient coverage, those visits and checkups that don’t require an overnight stay in the hospital. The standard monthly premium is just under $150 for single participants earning $85,000 or less and married couples earning $170,000 or less.

- Medicare Part C, also called Medicare Advantage, is a bundled plan sold by a private insurance company that covers everything you would get in Part A and Part B. These plans are for people that want an all-in-one plan and can offer lower premiums when you use in-network doctors and hospitals.

- Medicare Part D covers prescription drugs and is sometimes covered in a Medicare Advantage plan. You pay a monthly premium and a co-pay each time you need prescriptions filled but only up to a yearly out-of-pocket maximum.

Even if you decide to go with a Medicare Advantage plan with extended coverage beyond basic Medicare, you still need to enroll in Medicare to get access to these private insurer plans. The way it works is you enroll in Medicare within three months of your 65th birthday and then talk to an insurer about additional coverage on their plans.

You generally pay the Part B premium to Medicare and then an additional monthly premium to the insurance company. Total out-of-pocket premiums vary but range from $150 to $200 per month and can cap your total out-of-pocket expenses at a few thousand a year.

What is Long-Term Care Insurance?

Long-term care (LTC) insurance is a growing necessity as people live longer but still fall risk to debilitating illness and need more intensive healthcare. Long-term care covers a range of services from assistance at home with daily activities to care in a nursing home.

The Family Caregiver Alliance (FCA) found that nearly two-thirds (63%) of people age 65 and older need long-term care at some point in retirement. Nearly one-in-five older people will incur more than $25,000 in out-of-pocket costs for long-term care.

The average daily rate for a private room in a nursing home is $248 or $90,500 annually.

Regular Medicare coverage doesn’t cover many of the additional costs for long-term care. Purchasing an LTC insurance policy early can help save you from financial ruin in the event you need extended care. Premiums vary by state and depending on your health but the range is between $2,800 to $5,600 per year with an average premium around $280 per month for a couple in their 60s.

Dictionary of Retirement Health Care Insurance Terms

- Activities of Daily Living (ADLs) are common daily tasks that you get help with when covered by an LTC insurance plan. ADLs include eating, dressing, bathing, getting up and around and using the restroom.

- Elimination period is the number of days, starting from the date of an insured event, before benefits are paid on disability and LTC policies.

- Medigap insurance are policies sold by private companies to cover expenses not provided by Medicare.

- State Health Insurance Assistance Program (SHIP) is a state-run program that provides free information and counseling about senior health insurance issues.

Health and Long-Term Care Insurance Action Steps

- Apply for Medicare within three months of your 65th birthday and contact your employer’s human resources office to understand how your health insurance or COBRA benefits can coordinate with Medicare.

- Beware of health insurance fraud as scammers are on the watch for people entering their Medicare signup period Never give out your social security or Medicare number over the phone unless you know the person or organization.

- Contact your local State Health Insurance Assistance Program for more information on Medigap and LTC insurance questions.

- Talk to family about long-term care and alternative options like limited family caregiving that might make it possible to lower your premiums with a smaller coverage amount.

Nobody likes paying for nothing but healthcare and LTC insurance is a must as you get older. With potential costs well into the tens of thousands even on basic Medicare coverage, healthcare costs can wipe out a lifetime of savings in less than a few years. Accept healthcare insurance as a necessity and learn all you can about how to get the best policy.

Critical Changes in Your Retirement Investments as You Age

As if investing decisions aren’t difficult enough, they only get more confusing as you approach retirement.

On the one hand, you need to start thinking about protection rather than growth. You don’t want to see your nest egg cut in half during a stock market crash just before you retire so most advisors recommend shifting more money to safer bond investments.

On the other hand, you aren’t going to be contributing to your retirement savings anymore and whatever you have might need to last 30 years or longer.

Throw in other problems like inflation and taxes and your retirement investments might not last as long as you thought they would if you don’t have a plan.

How does Investing Change in Retirement?

There are a lot of issues that affect your investment decisions in retirement including when you can start withdrawing from different accounts, how to invest to keep up with inflation and how to manage your withdrawals to reduce taxes.

Try answering a few questions on retirement investing before we get into the details of how investing changes as you age.

Employees can contribute up to $18,000 annually into an employer-sponsored 401k plan and most plans include some form of company matching. You can also contribute up to $5,500 into a traditional or Roth Individual Retirement Account.

You can contribute even more each year once you reach age 50 in what’s called ‘catch-up’ contributions. You can contribute an additional $6,000 annually into your 401k plan and $1,000 into an IRA plan.

You might not be able to max out contributions in these retirement accounts but you should absolutely try to contribute up to the max for your employer’s match. Many employers will match contributions of up to 3% of your salary. That’s not a high hurdle to meet and you’ll be getting free money in your retirement savings.

The biggest complaint I hear from people about contributing to retirement accounts is they don’t want to lock up their money until age 59 ½.

Yeah, you can’t touch your retirement money until you’re nearly 60 years old but do you really think you aren’t going to need any money to retire? You get an instant tax deduction and can save a fortune in taxes while the money is in your retirement account…that’s free money that you’re losing if you don’t take advantage of retirement savings accounts.

How Investments Determine When You Can Retire

Stocks have historically earned between two- to three-times as much as bonds on an annual basis but come at a much higher risk. If you have twenty years or more to retirement, you don’t have to worry about the ups and downs of the market – you can be pretty sure stocks will rebound before you need the money.

As you get closer to needing your nest egg for living expenses, you get less able to survive the catastrophic loss in a stock market crash.

That means slowly shifting your investments from riskier stocks to safer bonds and other assets as you get closer to retirement.

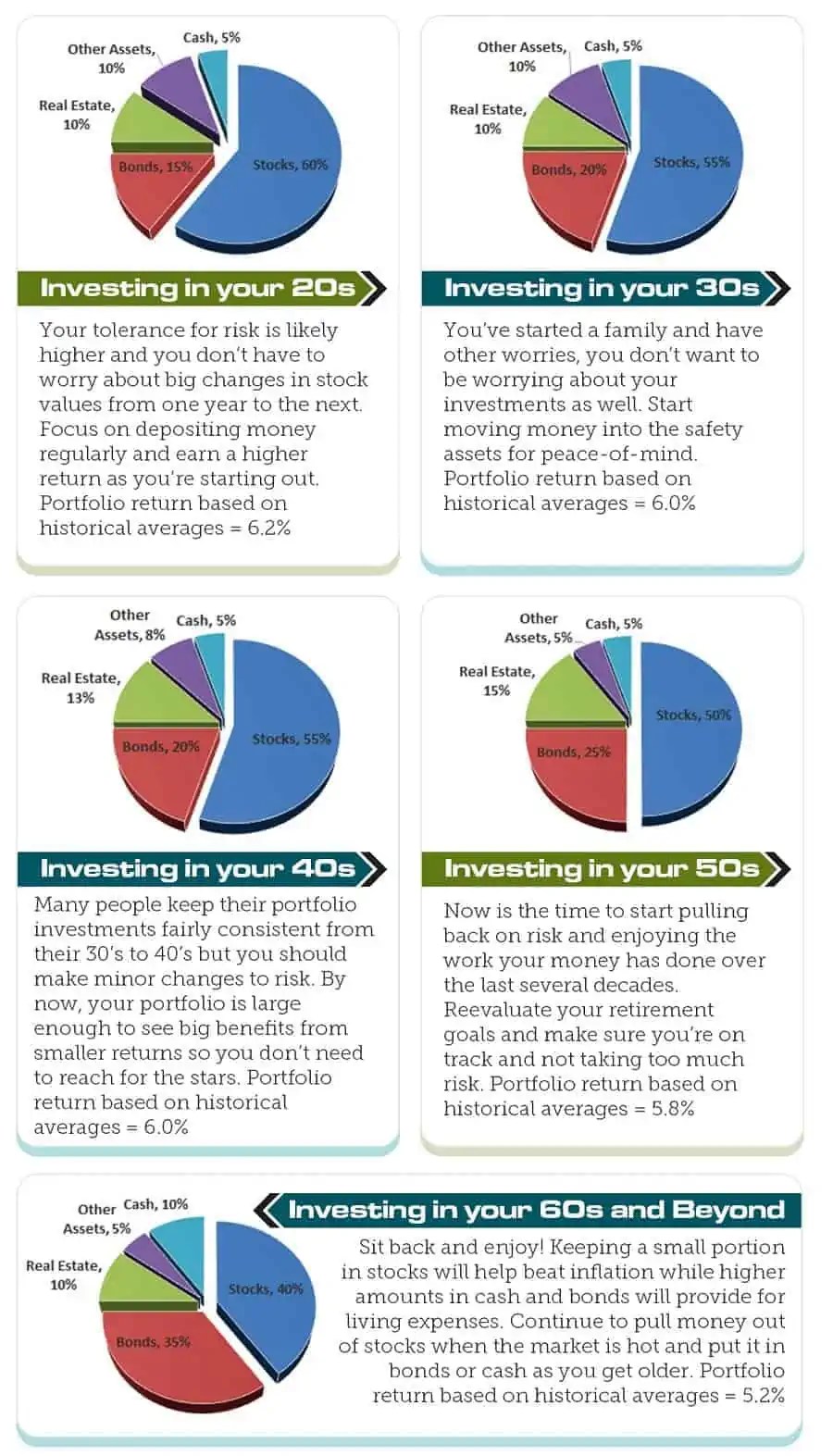

You might start investing in your 20s with nearly everything in stocks, keeping maybe 25% in bonds and real estate to smooth out your portfolio. By the time you get to age 60, your portfolio has flipped and now has 60% in bonds and safe assets.

Your investment shift doesn’t happen at once but is more like a small adjustment every ten years.

The percentage you invest in different asset classes will depend on your goals, risk tolerance and personal investment policy. I’ve put together four sample investment portfolios by age as a guide.

A higher percentage in stocks when you’re younger gives you the earning power to meet your retirement goals. Shifting money to bonds and real estate as you get older helps to lower the risk of big changes in any given year.

You’ll always want some investments in stocks to give your portfolio enough earning power to beat inflation. Don’t hold too much in stocks though or you could see your nest egg crack just when you need it most.

Important Investing Terms for Retirement Age Investing

- Annuity is a contract with an insurance company to guarantee regular income in retirement in exchange for a lump-sum or periodic payments now.

- Asset allocation is the percentage of your total portfolio you have invested in each of the assets (stocks, bonds, real estate, other assets and cash)

- Exchange Traded Funds are like mutual funds, groups of investments you can purchase with one fund, but are less costly. ETFs trade just like stocks and have lower management fees than mutual funds.

- Portfolio is your combined holding of stocks, bonds, real estate and any other investment.

- Tax-deferred is an investment where income taxes are postponed until you withdraw the money.

Resources for Retiring Investors

My Stock Market Basics – my investing blog with no-nonsense advice learned over decades as an investment analyst. No stock-picking or get-rich ideas, just stress-free ways to make your money work for you.

American Savings Education Council – is a program of the Employee Benefit Research Institute and provides calculators and advice on investing and saving. I also have a 401K contribution calculator that will estimate your income in retirement.

Ally Invest is a division of Ally Bank, offering one of the most inexpensive online investing platforms as well as professional assistance in investment management. You can open a taxable or retirement account with no minimum and no hidden fees.

Investing into retirement doesn’t have to be complicated. After a lifetime of saving, you shouldn’t have to worry that your money is going to be there when you need it. Take advantage of tax-deferred retirement accounts and gradually shift your portfolio to safer assets as you age.

How to Create a Retirement Paycheck

The Pension Policy Center found that one-in-two Americans age 65 and older had just $22,887 in annual income.

That’s just $1,907 a month to live on…including Social Security benefits and that’s before taxes take a bite.

Living the retirement you’ve always dreamed about, the retirement you deserve, means creating a retirement paycheck from multiple income sources. That includes withdrawing from different retirement accounts to minimize taxes and even creating other sources of income.

Take a shot at these questions about retirement income before we look at how you can create a retirement paycheck.

What is a Retirement Paycheck and the Average Retirement Income?

Don’t worry, a retirement paycheck doesn’t mean you are pushing work into retirement. It’s just another word for how you manage your income sources in retirement.

Creating a retirement paycheck is about using the assets you’ve built up over a lifetime to provide stable and reliable income when you need it.

Withdrawals from retirement accounts are taxed differently. That means you can manage your withdrawals to cut down on taxes and have more left to spend.

- Withdrawals from 401k and traditional IRA plans will be taxed as income so it’s best to wait as long as possible to take money from these accounts.

- Withdrawals from Roth IRAs are completely tax-free so use money from this account in years when you have higher income and are worried about being pushed into a higher tax bracket

- Withdrawals from regular investing accounts will be taxed on lower capital gains rates since you already paid income taxes on contributions.

- Income from municipal bond investments are tax-free and may make sense for people in higher income tax brackets

Terms You Need to Know to Create a Retirement Paycheck

Capital Gains Tax is the tax you pay on the increase in an investment when you sell it. If you hold an investment for longer than a year, capital gains taxes are generally 15% of the profit.

Defined Contribution Plan is an employer-sponsored retirement plan offering employees the opportunity to lower their taxes and receive an employer matching contribution into a 401k.

Traditional IRA is self-managed retirement account with contributions deducted from reported income in the year they are made. This creates a tax deduction incentive for retirement savings though all money is taxed as income when withdrawn.

Roth IRA is another type of self-managed retirement account. Contributions are not deducted from reported income so you don’t get that immediate tax deduction but all money is tax-free when withdrawn. There are income limits to contributing but even high-earning families can contribute to a Roth by converting traditional IRA money and paying current taxes on the amount.

How to Create a Retirement Paycheck from Different Income Sources

Creating the largest retirement paycheck possible means understanding how to use your retirement assets and social security benefits. It also means diversifying your income across different sources to lower your risk.

- The longer you can delay collecting social security benefits, the more you’ll get every month. The average benefit is around $1,360 but can be as high as $1,800 a month if you wait until 70 to start collecting.

- This doesn’t mean you can’t retire before 70 but using other income sources to fund retirement while delaying Social Security will maximize your paycheck.

- Consider buying an annuity to guarantee a certain level of income in retirement. This will mean you can take more risks, investing more in stocks for a higher portfolio return throughout retirement.

- Contribute to both traditional and Roth IRA plans so you have taxed and tax-free income available. Withdraw tax-free assets from your Roth and let the traditional IRA investments grow tax-deferred for as long as possible.

I realize work from home strategies and side-hustle jobs aren’t for everyone but they can be a great way to supplement your income in retirement. I’ve built my five blogs into a six-figure annual income but even smaller projects can produce a couple thousand a month. The beauty of many of these is that they can become a passion project in retirement, keeping you busy and increasing your income.

Retirement Income and Expenses Worksheet

Knowing how to create a retirement paycheck starts with understanding where your money will come from and how much you’ll need in retirement. Use the worksheet below to estimate income sources and expenses in retirement.

Creating a retirement paycheck isn’t about making money appear out of thin air. It’s about managing your different income sources to produce as much money as possible. Working through the strategy above, you’ll be amazed at how far you can stretch limited resources and how fast your retirement income will grow. It’s like financial magic!

Why You Can’t Avoid Estate Planning

As many as three-in-four people never create a will or plan for what will happen to their estate after they die. Nobody wants to think about their own mortality and some people don’t care what happens to their property when they’re gone.

But don’t think of a Will or estate planning as something for your own benefit. Think of it as something you do for your family and loved ones.

A Will saves unnecessary hassle for your family at a time they are in mourning. It will also make sure your estate goes to your heirs quickly and without costly legal fees. Rocker Jimi Hendrix died without a Will and the court battle over his $80 million estate lasted 34 years.

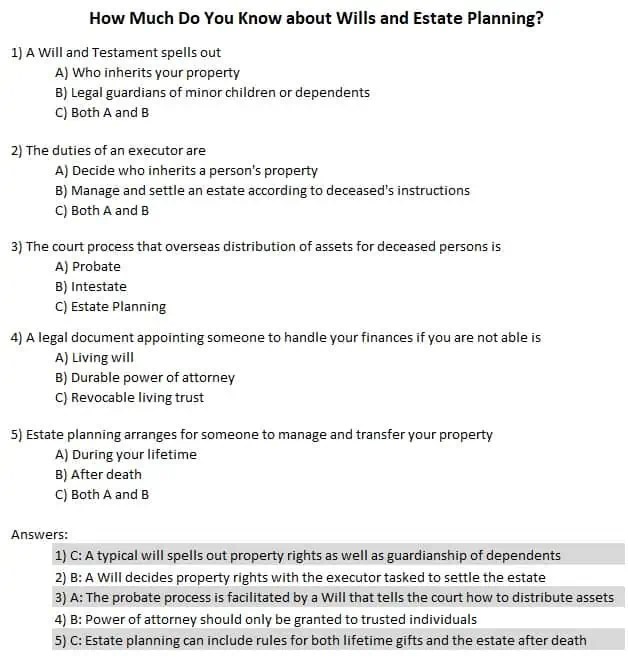

How much do you know about Wills and estate planning?

Stop Avoiding Your Estate Planning

As the saying goes, “You can’t take it with you.”

Nobody wants to think about their own mortality but it is going to happen. Even if you don’t think you have enough possessions to matter, leaving your estate without a Will causes unnecessary stress and burden on family and loved ones.

The goal of estate planning is to make sure your assets are distributed the way you want, with the least amount of taxes and with the least amount of stress for your heirs.

If you die intestate, without a Will, the state probate court will appoint an administrator to oversee and manage your estate. The administrator’s duties include paying final expenses and distributing assets but it comes at a cost. The administrator’s fees along with other expenses will come out of the estate before what’s left is distributed to heirs.

What Everyone Needs to Know about Estate Planning

- Designate at least two executors in case one is not willing or able to serve when needed. One can be a friend or family member with the other being a lawyer or estate planning professional.

- You should consider seeking professional help at least for the initial draft of your Will. State laws on survivorship rights like how much of your estate must go to a spouse or dependents might override your wishes for distribution.

Estate Planning Terms

Beneficiary is the person entitled to a deceased person’s income or property.

Codicil is a written document that changes, revokes or adds sections to a Will.

Contingent Beneficiary is a person second-in-line if the primary beneficiary is not able to take possession.

Durable Power of Attorney is a legal document that appoints someone to handle your finances if you are not able to do it.

Executor is a person named in your Will to administer the estate after you pass.

Living Will is a document that expresses a person’s wishes regarding prolonging life by artificial means.

Estate Planning Worksheet

Unlike what you might see on TV, a hastily-worded note on a napkin cannot serve as a will in most states. Rules will vary but generally Wills must be witnessed by at least two people during signature.

- Pull together all information about your personal property including bank statements, investments, retirement accounts, cars, jewelry and insurance policies. Anything of value over $1,000 should be included in your Will.

- Make an appointment with an attorney to draft your Will, durable power of attorney and living Will.

Beyond simply creating a plan for your estate, you need to make sure that whoever handles your estate can find everything. This means using the estate planning worksheet below to record the location of important documents as well as necessary passwords for access.

Keep your Will in a safe place after signing, either in a safe-deposit box at the bank or a fireproof box at home. Don’t forget to revise your Will after major life events like marriage, birth or adoption, death of someone in your Will or significant changes in your wealth.

Estate Planning Resources

AARP Legal Services Network offers members reduced legal fees for attorneys that meet AARP standards – http://www.AARP.org/financial

NOLO is an online resource for legal forms and information as well as offering a Find a Lawyer service. Check out the websites articles on being an executor, creating a Will and planning your estate.

Estate planning shouldn’t be something you avoid or are afraid to talk about with family. Creating a Will now and talking about how you want assets distributed will be much easier on loved ones than letting them decide it at the worst possible time.

Managing these five topics in retirement planning puts you ahead of the vast majority of seniors in America. Many people let their finances ‘just happen’ as they get older and don’t realize the importance of guiding their financial retirement. Tackling the most important issues as you get older will help answer the question, “When can I retire?” and get you to the retirement you deserve.